- FR

- EN

Trade Credit (re)Insurance during the Covid-19 crisis

P&C Technical Newsletter #58

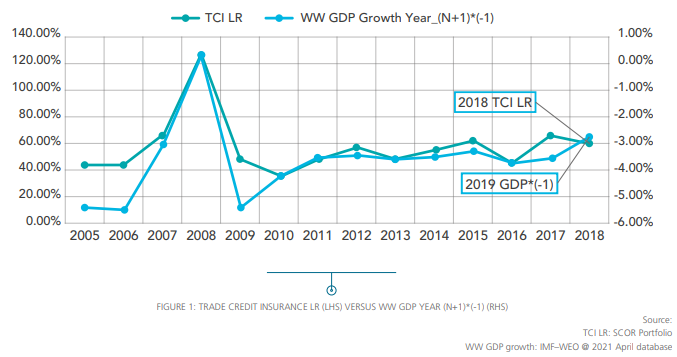

At the beginning of 2020, as Covid-19 started to spread around the world, governments were forced to impose abrupt lockdown measures on their populations, resulting in a sudden quasi-global economic standstill and consequently a significant drop in global GDP, at levels comparable to those observed during the Great Depression of the 1930s. The anticipation of such a massive drop in global GDP over a sustained period raised fears of a significant increase in overdue payments and claims for the Trade Credit Insurance (TCI) line of business.

However, more than 18 months after the pandemic first began, loss ratios for the TCI market have stayed at benign levels, and in some cases have even remained below pre-Covid-19 crisis levels.

This Technical Newsletter aims to better understand, pinpoint and quantify some of the drivers of this remarkable disconnect. Along the way, we will be commenting on the perceived impact of the TCI backstop schemes swiftly implemented by many governments, the insurance management and reductions relating to critical obligor exposures, the increases in primary policy rates implemented within the market, and the de-risking of portfolios by leading TC Insurers going into 2020, obviously for reasons other than Covid-19.

The newsletter focuses specifically on the connection between (global) GDP and TCI loss ratios, and what we have identified as some of the significant factors behind this remarkable dissociation between the Covid-19 crisis and TCI losses, which we argue is closely linked to government measures implemented to support businesses and employees on a massive scale.

Furthermore, we believe that the economic crisis triggered by Covid-19 has revived the public perception that TCI can potentially amplify a systemic economic crisis through significant and sudden credit limit cancellations, and that government spending/backstops designed to alleviate this economic crisis are implicitly socializing losses that would otherwise be assumed by private TC Insurers1.

We will explain why we do not totally share this public perception, and we will contemplate and propose a possible way in which the Trade Credit (Re)Insurance industry, jointly with the public, could help to make economies even more resilient in times of systemic economic crisis.