Prevention is better than cure

A proactive approach to health management enables an individual to manage, postpone and even prevent some medical conditions.

5 décembre 2019

- A proactive approach to health management enables an individual to manage, postpone and even prevent some medical conditions. If insurers can help to facilitate successful health management, they stand to benefit from reduced risk and through building more valued relationships with customers. The challenge for insurers is to establish a role in a field in which they have no natural credibility or expertise.

- Whether willingly or with the coercion of their doctor or employer, 60% of respondents reported having a regular health check. For others, the cost or inconvenience of undergoing regular screening has limited take-up. Technology could present a cost-effective way to overcome these barriers.

- Partnering with medical technology companies that have expertise in the field of health management offers insurers the means to monitor and reward policyholders who take active steps to manage their health.

A truly comprehensive approach to health management encompasses not only the lifestyle choices discussed in the previous section but also regular monitoring to identify latent conditions. Proactive monitoring delivers significant benefits by reducing the frequency and severity of medical crises. By identifying potential health issues at an early stage, it is easier to manage or postpone the onset of conditions and even to prevent them from occurring. Lives can be saved – and money too – by reducing the need for costly hospital intervention.

Early detection, better outcomes

A few countries have screening programmes that are designed to detect conditions, such as cancers and heart problems, where early detection enables individuals to access effective treatment or, in some cases, to make lifestyle changes that will manage or prevent the condition altogether. This is particularly true of many forms of cancer where outcomes are vastly improved with early intervention.

Many countries are seeing a rise in the incidence of Type II diabetes. This has a long asymptomatic period during which it can be detected through blood or urine tests. Diagnosis at this stage makes it easier to prevent complications such as nerve damage, kidney problems and strokes. There is also evidence that, through changes in diet and weight loss, some diabetics can put their condition into remission.

Checking on health

Clearly, keeping fit is a critical element of a proactive health strategy and in Theme 1 we sought to gain insights into consumers’ attitudes to fitness and wellness. But, given the importance of detecting potentially damaging latent conditions, the survey also sought information from respondents about the frequency with which they underwent a medical check-up.

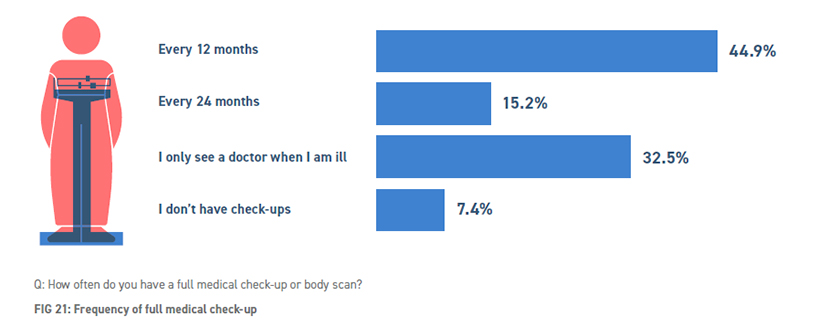

The survey found that 60% of respondents have a full medical check-up or body scan at least once every two years, with just under half (45%) of respondents having a check-up every year (Fig 21). It is encouraging to

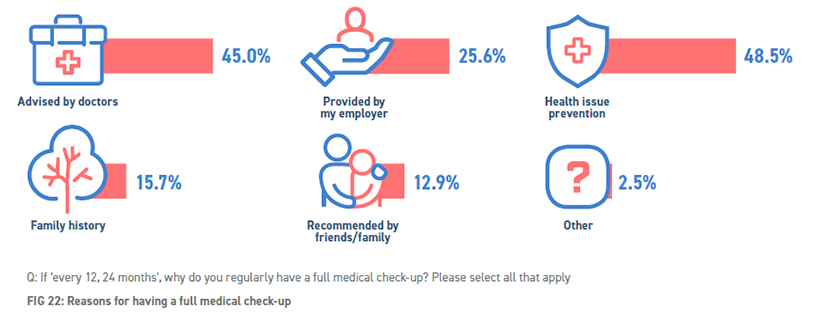

see that such a high proportion of the respondents seem to have bought into the merits of proactive health management. However, it is also important to understand what drives the respondents to undergo a regular medical check-up. Around 50% cited the prevention of health issues as being a motivator while 45% said that the check-up had been triggered by doctor’s advice.

The role of the employer can also have a significant influence. Overall, 26% of respondents reported having a regular check-up because it was provided as a workplace benefit. Amongst Japanese respondents this proportion swelled to 47% (Fig 22).

Age does influence the likelihood of an individual having a regular health check. At the youngest end of the spectrum, 34% have an annual check-up, compared to 57% of the over 55s. This may be due to national health screening programmes targeting those at greatest risk, which is often, though by no means always, the older generation. Furthermore, the older generation is more likely to have developed conditions that require regular screening.

That so many people willingly, or with the coercion of their doctor or employer, engage with their health is encouraging but it still leaves around a third of respondents who do not see the need. Notably, respondents in certain countries are more likely to leave a visit to the doctor until they are ill. This is the case for 48% of Malaysian respondents, 47% of South African respondents, and 46% of those in the UK. Understanding the reasons for their reluctance can help to overcome these obstacles and encourage them to engage more actively with their health.

Technology to the rescue

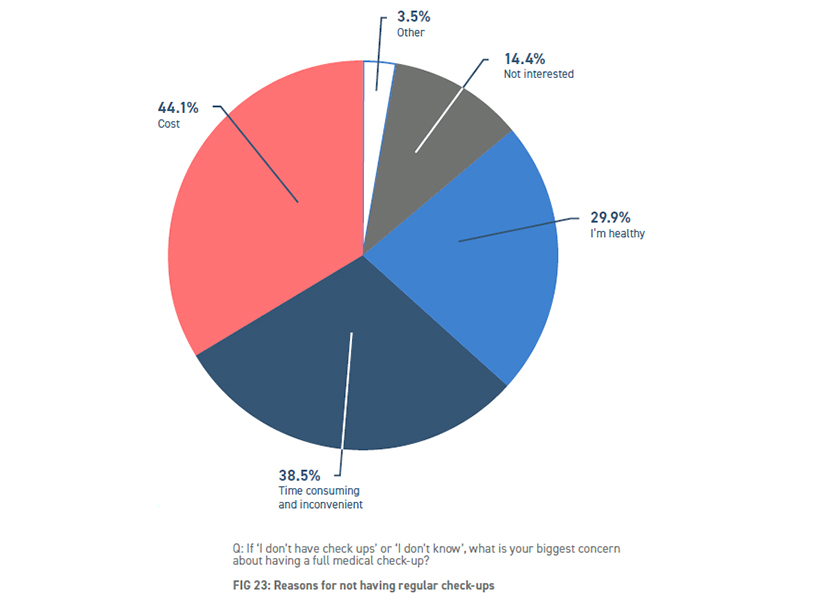

Amongst those who did not have a regular health check, the biggest barriers were cost, which was cited by 44%, and the time and inconvenience, noted by 39% (Fig 23).

The answer to overcoming these barriers May lie in technology. A number of technology companies are working on systems and equipment to facilitate health management through convenient monitoring and reporting of health data.

Some are designed to track markers and treatment for specific conditions such as those that track blood pressure and heart rate in order to monitor stroke risk or those tracking the metrics associated with Type II diabetes. Other systems in development are designed to capture data relating to a broader family of conditions.

These systems are set to revolutionise the possibilities for active health management.

The genetic inheritance

One of the most significant developments to advance the understanding of health risks is the science of genetic technology. Testing of DNA has the capability to determine an individual’s predisposition to a variety of diseases, including some forms of cancer, Parkinson’s disease and Alzheimer’s. In some cases, a specific genetic mutation will confer a very high degree of certainty that the associated condition will, at some point, develop. In other cases, it will merely indicate a predisposition to a condition, the emergence of which will be highly dependent upon a host of environmental factors. The cost and complexity of such a test have reduced significantly. Today, genetic testing is readily available in the consumer market. It can be conducted in a doctor’s clinic or with a testing kit at home, with results generally available in a matter of days.

Taking the test

Given the critical importance of genetic science upon health management, this study sought to test consumer attitudes to, and understanding of, the fast-developing science.

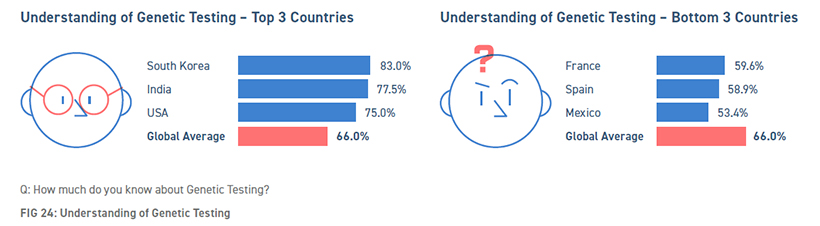

Awareness of genetic testing is high. Our study found that 66% of respondents had at least some understanding of the subject. This understanding was even higher in some countries – 83% of respondents in South Korea and 78% of those in India (Fig 24).

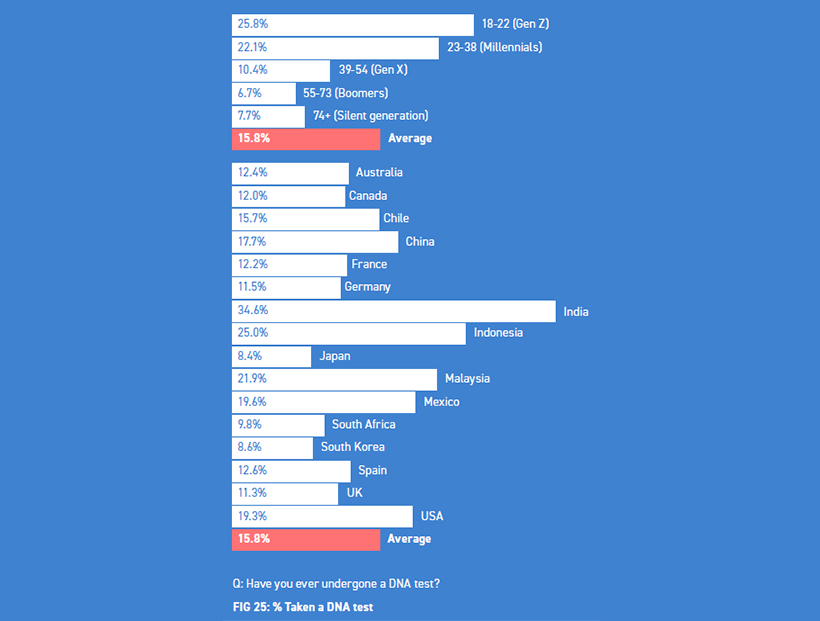

However, this awareness has not translated into a high take-up, with just 16% of respondents saying they have had a DNA test. The survey suggests that younger people are more likely to take a test, with 23% of the under 38s compared with just 7% of the over 55s. There are quite marked variations between the responses in different countries. Take-up rates in India and Indonesia are 35% and 25% respectively while, at the other end of the spectrum, the take-up rate in Japan was only 8% and in South Korea only marginally higher at 9% (Fig 25).

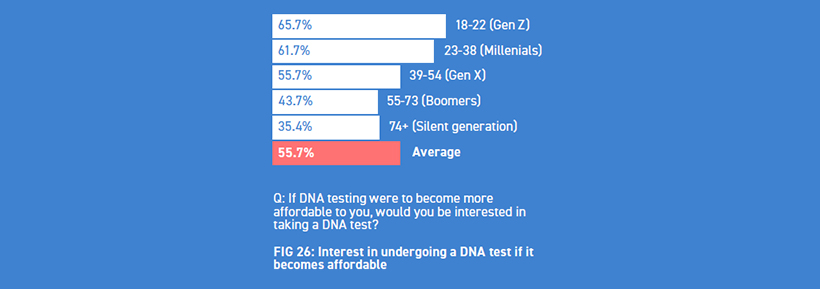

This survey suggests that reducing the cost of testing would provide a boost to public interest. 56% of respondents indicated that they would be interested in taking a test if it were affordable. This interest is higher among the younger respondents with nearly two thirds (63%) of Gen Z and Millennials keen to take a test at an affordable price, compared with 36% of the Silent generation (Fig 26).

Insurers in search of a role

The potential to improve consumers’ health through a proactive approach to health management is of huge interest to the life insurance sector. It is not only of benefit to policyholders but also to insurers through reduced risk and the greater insight gained through positive engagement in the health of their customers.

The challenge for insurers is to demonstrate that they have a meaningful contribution to make.

Within their own resources, insurers have little credibility or knowledge in the field of preventative health. Furthermore, in the field of genetics, their motives may be viewed with suspicion. Experts in the field of genetics have a mistrust of the industry’s competence to quantify, with any degree of accuracy, the impact of genetic mutations upon mortality. The concern is that clumsy attempts to use genetic testing as an underwriting tool will discourage the take up of testing and hinder the development of an area of science that has the potential for huge positive benefits for health management.

As a result, many countries have regulations and codes of practice to limit insurance companies’ access to genetic information.

Cooperation is the key

Partnering with medical technology companies that are working in the field of health management offers insurers the means to monitor and reward policyholders who take active steps to manage their health.

One such plan offers cover to Type II diabetic patients. By partnering with a company that provides technology

to facilitate the management and reporting of relevant health data, the insurer can reward those customers who demonstrate successful management of the condition with a premium adjustment.

In another example, the insurer has an arrangement with a genetic testing company to provide customers with an analysis of their genetic makeup along with recommendations to improve health management. The focus is on preventable conditions such as stroke and heart disease and the aim is to guide clients to optimise lifestyle and diet. There is no sharing or transfer of customer data to the insurer, but they benefit from the lowering of risk that this service helps to bring about.

These examples demonstrate that by cooperating with experts in the field of monitoring and reporting, insurers can play a part in a virtuous circle of health management and reward.

This article is part of the latest ReMark’s study of consumer behavioural trends in the insurance industry live in October 2019.