- FR

- EN

At the 2019 SCOR Annual Conference, Sylvain Gauden, Chief Underwriting Officer for Marine and Energy at SCOR Global P&C, led a panel that explored how industries leverage technology and data – including blockchain, big data, artificial intelligence and predictive models – to better monitor their supply chains and improve security and services. Panel members included Francoise Carli of SICMEC; Lars Henneberg of MAERSK; Michel Josset of FAURECIA; and Pauline Des Vallières of SCOR Global P&C.

By Sylvain Gauden

Although the economy is shifting from tangible to intangible assets, trade in material goods continues to grow. Sea-born trade accounts for some 71% of all trade. Today some 12 billion tons are shipped every year – equivalent to 1.5 tons per capita – up from 4 billion in 1900. In other words, the volume has tripled in less than 30 years.

Shipping costs have decreased as the volume has increased, but the supply chain has become more complex. Issues of storage, packaging, regulations, taxes and others have made the supply chain more and more challenging to manage.

Data can help and indeed, supply chains are huge consumers of data. The question is, how do you manage the data? Today paper is still very important in shipping, but this needs to change. Big data combined with artificial intelligence are allowing us to build better predictive models, and to better assess and understand our risks.

I asked the participants in this panel to share their experiences with leveraging technology and data.

Sylvain Gauden, Chief Underwriting Officer for Marine & Energy, SCOR Global P&C

Lars Henneber: At MAERSK, how has data impacted your business model?

Simplification of business processes is a big priority for MAERSK. We see it as a means of improving our customer service. We can afford to lose a vessel, but we can’t afford to have our data management system go down. Better protection, risk planning and recovery processes are critical in our digital business model.

In 2016 our board launched a strategic transformation: to make MAERSK a transport and logistics company, not just a shipping company. This means covering the full supply chain, from door to door and warehouse to warehouse, creating a one-stop-shop for the customer.

We already had most of the pieces in place. We just needed to expand the portfolio a bit on the land side and to put it all together into one cohesive service. Working with IBM we digitized the global ecosystem of world trade. We created a platform that standardizes and integrates all of the complex processes in transportation and logistics, from bookings and movements, to customs declarations, insurance and finance. Today our customers interact digitally and get everything they need from the same data source. This means better business for us and better service for our customers.

Insurance is a big part of the complexity of shipping. In the risk management department, we typically spent about 70% of our time on insurance contracts. Now our vessels are all connected, enabling us to change the discussion around insurance: more about risk and less about procurement. Data enables us to think about emerging risks – to do predictive analytics – and to monitor and manage risk much more effectively. Because we have many more data points and providers, we can do much more tailored risk management and we can differentiate risk in real time.

Finally, we are reducing the administrative burden, using blockchain, algorithms and other data processes to streamline our transactions. Everything that was previously done manually is now automated, making our insurance services faster and cheaper.

Lars Henneberg, Vice President, Heard of Risk Management, MAERSK

Michel Josset: How is FAURECIA innovating to control losses in the supply chain?

In the automotive industry, the supply chain is very long and complex. Any interruption can have serious financial consequences. Several events in recent years have hit the supply chain hard, from the Fukushima quakes to the Thailand floods, to fires in the Czech Republic and the US.

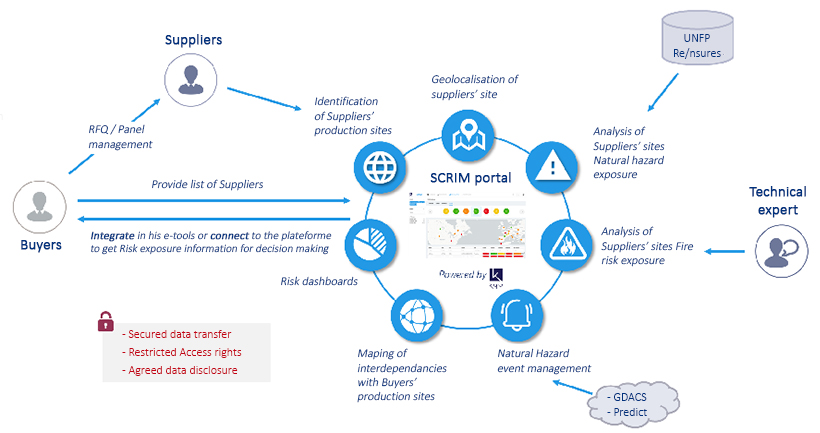

Insurers are lowering the tiers for coverage and reimbursement because of the unpredictability of risks, so we are moving more to loss control and prevention. We have started to collect information on our top suppliers – not only to evaluate suppliers but also to assess their physical risks. This makes risk management routine – and makes their lives easier.

The main challenge is mapping the supply chain. We need to collect a lot of information on suppliers’ production sites and then make the connections with objective data on natural hazard exposure. We have created a dashboard to do this, but because the data collection is costly and time-consuming, we have realized that we cannot do it alone. By externalizing the data collection process to a third party, we have lowered the cost and also limited conflicts of interest. And finally, the dashboard allows us to warn customers as we see dangers evolving.

We plan to share the information with insurers transparently. In this respect, one of the challenges is confidentiality. We need to make sure that the information provided by suppliers is protected.

Michel Josset, Group Treasury/insurance, Loss control; Real estate Faurecia

Francoise Carli: As Co-Founder of SICMEC, can you share with us your view on data management in the supply chain?

In the late 1980s everyone was talking about data in the marine industry, but the conversation revolved around a few critical points, among them pricing and claims management. In other words, it was driven by what the insurers required. No one was really focusing on customer needs.

In the 1990s there was a shift. We began to ask ourselves: Is there information that the customer would like to have that is not really driven by insurance concerns?

But the marine industry is still living in ancient times. We are still trying to figure out what kind of data we have. This means that the industry faces a big risk: if we keep on the way things are, by 2025 there won’t be any more marine insurers on the planet. You won’t be able to get insurance coverage for the goods you are shipping, especially when this happens in areas that are critical for risk management.

We really need to use data differently. We need real predictive models: not only what and where the products are, but also what’s going to happen? This is critical so that you aren’t insuring in the dark.

The truth is that insurers all have tons of data – but nobody wants to share it. You share it only when there is a problem. Sharing is key. You all need the right information, and you need it when it matters. You need to be alerted as to where, when and how something is happening to your goods. For this, you need a trusted third party. This is what SICMEC aims to be.

Françoise Carli, Co-founder, SICMEC

Pauline Des Vallières: Can you tell us how marine underwriting is evolving at SCOR P&C?

At SCOR, technology and big data are allowing us to use more precise and more predictive tools. We have identified three main challenges in doing this:

- Internally, we need to speak the same language.

- We need to make sure we have the right data.

- We need to convince management to go further.

The best way we have found to achieve this is to use the tools in our daily work. Thanks to the technology we have developed, we have been able to go from an exclusion-based policy to a more inclusive one.

For example, two vessels may seem to be technically identical: same type, same size, same flag, same owner, same age. Basically, this is the kind of static information an underwriter traditionally receives – between five and ten technical criteria, based on which two vessels may be assumed to have the same risks.

In actuality, however, one of those vessels may have sailed nearly twice as much as the other. This type of information is quite easy to find; it is available on the internet and may even be free. But an underwriter rarely has the time or the internal tools to study it.

Thanks to artificial intelligence, we can now add important behavioral data to the static data we have traditionally used. We can take into account more than 500 criteria, generating a predictive risk score and adjusting the premium to the risk.

We still have a long way to go to integrate all of this data into our daily underwriting. Nevertheless, one year ago we would have declined risks that today we are able to negotiate and underwrite, thanks to artificial intelligence-based analyses.

Pauline Des Vallières, Marine Underwriter, Specialty Insurance, SCOR Global P&C