- FR

- EN

How to insure long-term care

Most of us will need long-term care at the end of our lives, yet it is one of the largest uninsured risks facing the elderly.

Pierre Pestieau’s recent work, published through the TSE - SCOR Foundation ‘Risk Markets and Value Creation Chair’ examines the reasons for the surprisingly narrow market for long-term care insurance, and advocates the introduction of a private or public deductible.

Why is the funding of long-term care so important?

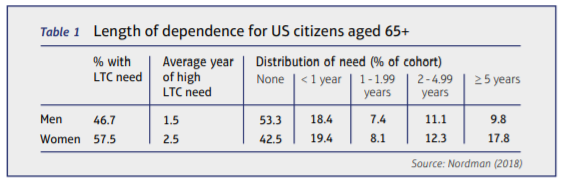

The rise in long term care (LTC) needs is a major demographic challenge. The number of Europeans in need of LTC is expected to grow from 27 million in 2013 to 35 million by 2060. According to a recent US study, more than half of 65-year-olds will ultimately have a high need of LTC (see Table 1). The poorest – especially women – are most at risk. For example, 22% of those in the highest income quintile will require care for more than two years; for the lowest quintile, this increases to 31%. About two thirds of LTC is generally provided by informal caregivers; recent figures show that about 80% of dependent individuals in the US receive informal care from relatives and friends. However, it is expected that the role of this informal LTC provision will decrease and it is not clear that the state, or the market, will be able to fill the gap. Financial risks associated with meeting LTC needs will then grow, increasing the urgency for the development of mechanisms to absorb these risks.

What explains the ‘long-term care insurance puzzle’?

Given that each person has a large probability to enter a nursing home in later life and given the large costs related to LTC, one would expect private LTC insurance markets to expand, in order to insure individuals against the - quite likely - substantial costs of LTC. However, although markets for private LTC insurance exist in most countries, they remain thin. On the supply side, high prices and the reimbursement formula are among the explanatory factors. Financial frictions and statutory regulations affect the profitability of insurance companies and may explain their relatively high loading costs they apply. The two main LTC reimbursement formulas are not attractive for those who fear to incur a too long period of dependence. Reimbursement policies pay for the actual cost of care. For example, if the chosen daily benefit is $100 and the actual cost of care is $90, the insurer will pay $90. If the daily cost of care is $120, the policy will pay $100 per day and the insured must pay the difference. However, this formula has a ceiling for both the amount and duration of the benefits. Cash indemnity policies pay the dependent the chosen daily benefit as soon they qualify, regardless of actual expenses. This benefit may cover the dependent for their lifetime but the amount is generally low. Neither formula meets the concern of those who fear becoming penniless or being forced to depend on their children because of an extended and costly dependency.

On the demand side, government-provided care may be crowding out private insurers with means-tested programs impacting both poor and affluent households. In the US, Medicaid imposes a high implicit tax on self-insurance via saving and, as a secondary payer, on the purchase of LTC insurance. Family solidarity can also reduce demand: parents might refuse to buy insurance if it reduces children’s incentives to provide care.

Alternative explanations involve behavioral bias. Ignorance or lack of self-control can cause our choices about buying insurance to be based on how we perceive the risk of old-age dependency, rather than the actual risk. Old-age dependency is also a singular event in one’s life, so insurance against LTC costs cannot be treated like standard insurance (e.g. against domestic fires). Dementia, disability, and death generate anxiety, and this may encourage a refusal to face reality.

Which solution does your research support?

Concerns about the risk of a long and costly dependency could be dealt with by a system in which individuals’ contributions to their LTC costs are capped at a certain amount, with full coverage for all further expenditures. Under the system proposed in the UK by the Dilnot Commission (2011), only around a third of dependents would reach the proposed cap of about £35,000, but everyone would benefit from knowing that they were covered, avoiding the fear and uncertainty of the current system.

We argue that this formula could be justified as an efficient insurance policy, applying Arrow’s (1963) theorem on insurance deductibles. Addressing the issue of health care, Arrow’s theorem states: “If an insurance company is willing to offer any insurance policy against loss desired by the buyer at a premium which depends only on the policy’s actuarial value, then the policy chosen by a risk-averting buyer will take the form of 100% coverage above a deductible minimum.”

Compared to health care, the random and costly nature of LTC introduces two specific dimensions: the risk of becoming dependent and the length of dependency. My research with Jacques Drèze and Erik Schokkaert (2016) shows that Arrow’s theorem holds for LTC, implying that policies should offer full self-insurance for the first years of dependency followed by full insurance thereafter. In other words, it is optimal to focus insurance coverage on the states with largest expenditures. My paper with Justina Klimaviciute (2020) shows that this result also holds with ex post moral hazard.

Can the deductible also be applied to the optimal design of social insurance?

In another paper with Justina, we analyze a setting with a non-linear scheme of income taxation and LTC insurance and explore how the optimal deductible amounts should be designed for individuals with different productivities. We show that the optimal deductibles for high- and low-productivity individuals are not always the same and that their comparison depends on absolute risk aversion and on whether both individual types have the same or different LTC needs. We also find that when the probability of dependence is negatively correlated with income, this strengthens the case for social insurance and might result in the optimal level of deductible being equal to zero or even negative.

Pierre Pestieau received his PhD from Yale. He taught economics at Cornell University and University of Liège, where he has been a professor emeritus since 2008. He is also a member of CORE, Louvain-la-Neuve, and a fellow at CEPR and CESIfo. His main research interests are pension economics, social insurance, inheritance taxation, redistributive policies, and tax competition