Underwriting must accommodate the foundational changes entering the industry, like it or not. For some, this presents welcome opportunity; but for others, it represents the discomfort and threat of change. As the current historical underwriting process is dismantled and reassembled, the need for strong cross-functional collaboration seems self-evident. The seat at the decision table for the underwriter comes at the cost of much expanded competence.

After a career of more than 40 years in underwriting working in the U.S. Life insurance industry, with the last 15 years spent in R&D-related work, it is quite appropriate to reflect on some of the many historical factors and changes that shape my opinions of the future of my chosen profession:

- Double digit interest rates in the early 1980s

- The continued rise of the brokerage distribution channel

- Company demutualization and industry consolidation

- Whole Life coverage yielding much of its impact to flexible UL products

- Consumer-directed investing of cash values via variable and indexed products

- Ever cheaper term rates making applications for many tens of millions dollars of coverage possible

- Challenges presented by inflexible, manual and paper-intensive processes

- The aging of traditional life insurance agents

- Shrinking market penetration amongst younger consumers

- An unforeseen pandemic

Regarding underwriting (UW), however, only three major changes of similar magnitude stick out to me during this long timeframe:

- the switch to greatly expanded biometric and fluid testing of applicants in response to the HIV/AIDS threat in the mid-1980s

- the emergence of preferred class underwriting in direct response to the expanded data from such testing

- paradoxically, the current and recent efforts to underwrite effectively without such biometric and fluid results often using non-traditional data

For a long time, preferred class underwriting in the U.S. has followed a rather persistent pattern across the industry. To be sure, there were differences between qualification measures, cut off points, number of preferred classes and so on, but the main template remained very similar among providers.

Fast forward to the current period, and it is obvious that there are foundational changes entering the industry that underwriting will have to accommodate, like it or not. For some, this presents welcome opportunity; but for others, it represents the discomfort and threat of change.

Looking forward to the future of the underwriting profession

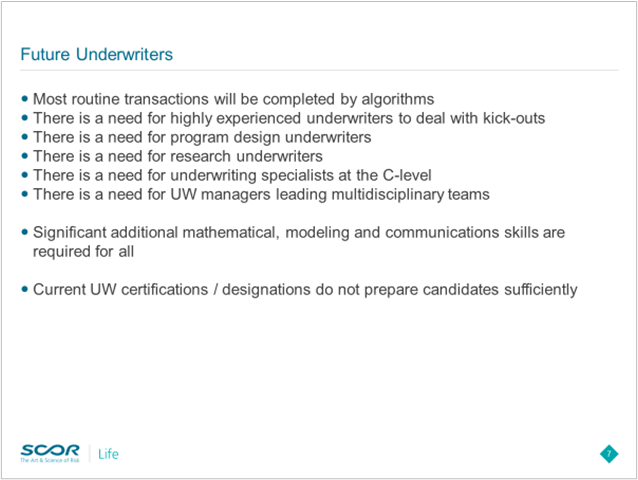

Recently I was asked to present some of my thoughts on the future development of the underwriting profession to a group of my peers. I take such requests seriously – being asked to share is an honor. Here is one of the final slides I composed for this purpose.

Let me expand a bit more on the basis my thoughts represented here – and to be sure these are my suggestions only. There is plenty of room for disagreement and difference.

First, some fundamental truths:

- Underwriting has no intrinsic stand-alone value. It exists purely to enable the process of issuing policies that have a reasonable chance of producing desirable outcomes.

- All true insurance (unlike some social programs using the term) must follow the basic principle of risk sharing. The misfortune of the few is equitably shared by the many.

- All products are the result of the contribution of many disciplines and areas of expertise.

- As the current historical underwriting process is dismantled and reassembled, the need for strong cross-functional collaboration seems self-evident.

All my suggestions for future UW career paths share this additional fundamental truth – the future underwriter will need to be able to explain convincingly in some detail to others, within or outside the company, how any particular input into the underwriting decision process specifically contributes to an expected outcome. It is no longer acceptable to hand off that explanation to others, whether they be actuaries, agents, marketers or managers.

That implies directly that the future underwriter needs to know and understand, in much more detail, how specific data inputs and underwriting process steps interface and support individual risk selection decisions and the other new business processes. The need for understanding and performing many aspects of data analytics in particular is rapidly growing as a critical underwriting skill.

Changes coming

Just to point out one example: Life insurance relies on the law of large numbers. Loosely interpreted, that means that events which are random and unpredictable on an individual level become predictable when referencing large groups.

Future underwriting paradigms are clearly trending towards greater individualization, which directly challenges that law. At what point is a large group no longer large but merely a collection of a few individuals created by such individualization? What impact does that have on the predictability of outcomes? What measures of credibility can be used? Where is the science that supports these underwriting rules?

In the past most underwriters would hand off these questions and considerations to their actuarial colleagues. I strongly suggest that going forward, with rapid development changes, ever-shifting data inputs and morphing regulatory demands, the underwriter needs to understand and communicate these dynamics every bit as well as the actuary. It is only from successful collaboration that a reasonable chance of business success will emerge.

Mathematics and data analytics cannot be viewed as the exclusive domain of actuaries and data scientists. Basic underpinnings of probability, differences between population groups or highly disparate mortality dynamics can be mastered without the need for advanced calculus. While creating and executing complex prediction models is the domain of data science, understanding how specifically these models perform can be understood by underwriters with some additional training. Furthermore, analyzing raw data and its inherent correlations and applicability is entirely accessible to anyone using modern desktop tools.

The seat at the decision table for the underwriter comes at the cost of much expanded competence. The future is bright, but continuous change and willingness to adapt, learn new skills, collaborate and participate are key requirements.

To my underwriting colleagues: Our future is truly what we make it.