- FR

- EN

Embracing Sustainability Principles in (Re)Insurance Corporate Venture

In this post, we share our approach to embedding sustainability principles holistically into our investment and partnership decision-making process.

SCOR’s recently published 2020 Climate Report reconfirmed our corporate Environmental, Social and Governance (ESG) commitments. P&C Ventures is equally committed to promoting sustainable principles and embedding these values within our investment strategy. Accordingly, we are excited to share our investment & partnership ESG Principles.

Our ESG Principles

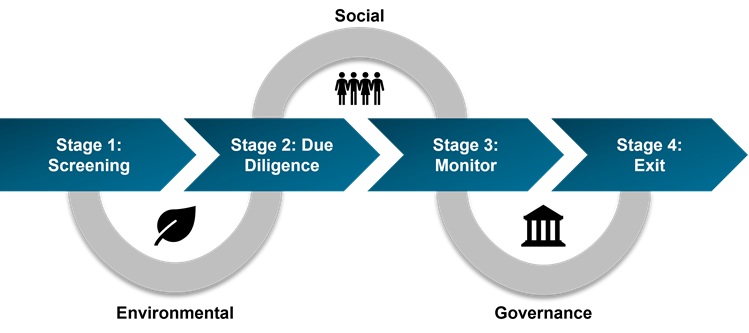

In March, we shared a blog setting out our three-year strategy, Ventures 2.0. We invest in and partner with (1) the ‘insurers of the future’ and (2) innovative technology solutions for the benefit of SCOR and/or our clients. To ensure alignment of values with our partners while we implement the Ventures 2.0 strategy, we have now embedded the following principles holistically into our decision-making process from pre-investment diligence to ongoing portfolio company development efforts.

While all of these principles may not apply to every investment, we believe that strong sustainable practices make for better businesses that have a greater positive impact and that ESG principles will inevitably become a universal standard. We are therefore committed to helping new and existing portfolio companies establish and advance their own sustainable initiatives.

ESG Principles In Practice

Due Diligence Processes

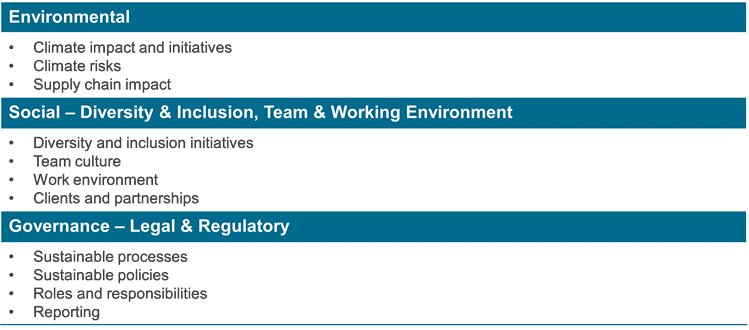

We have integrated ESG-related questions into our core diligence process. A sample of our question topics will include:

Acknowledging that ESG maturity will depend on the stage of the start-up (e.g., Seed vs Series C), the relative maturity level of the start-up will be considered as we tailor our question sets to fit the operations of the company. For example, our goal when working with Seed stage companies is to plant the first seeds towards implementing strong sustainable practices. For later stage companies, we expect to see fully developed sustainability processes and policies in place.

Business Ethics

Our ESG principles hinge on the presence of ethical business practices. Integrity, equality, honestly, and fairness are key components of business ethics. Business ethics hinges on the effective implementation of policies and procedures around fraud, bribery, discrimination, and corporate governance. During due diligence, we review the processes by which companies safeguard against unethical business practice, using SCOR’s Sustainable Investing Principles as a general reference framework to aid our evaluation.

Portfolio company development

P&C Ventures is committed to helping new and existing portfolio companies establish and advance their ESG initiatives. We provide support by, for example, sharing sustainable best practices and reviewing processes and policies. In the short-term, we are already having proactive conversations with portfolio companies to understand key ESG risks and their plan to integrate sustainable practices into processes and policies. In the mid-term, we will set expectations for ESG-related KPIs and collect these metrics on a regular basis, collaborating with our portfolio companies to improve their processes and policies.

Venture Community

We recently joined Venture ESG, a community of like-minded VC firms that are committed to integrating ESG practices into their end-to-end processes. We are encouraged and motivated by the actions of our peers. We would welcome feedback and the opportunity to connect with like-minded investors to discuss ESG investment strategies and continue to on-level our ESG approach.

Opportunities at the intersection of (re)insurance and Sustainability

Outside of our own processes, we see an exciting opportunity to support the development of sustainable solutions for the global (re)insurance industry. While we have always placed an importance on new and innovative climate-relevant insurance solutions, such as our partnership with Energetic Insurance, we are now taking steps to increase our commitments in this space, proactively monitoring trends to define potential investment theses and identify collaboration opportunities.

Benefitting from the significant experience of SCOR’s ESG team (also made available to our portfolio companies), we have worked with Paul Nunn, Camille Mauguy, Nathalie Mikaeloff and other internal experts and champions to understand the challenges arising from the speedy adaptation of the (re)insurance industry to key sustainability trends. We believe the following trends will start to coalesce into the formation of significant numbers of new start-ups in the next 6-12 months:

ESG reporting & disclosures

In the past year, regulatory developments addressing sustainability issues in the context of financial market participants have rapidly accelerated. The growing importance of ESG data is underlined by similarly rapid growth of demands from investors, regulators, and stakeholders for companies to disclose more about their sustainable practices. Notable ESG data and reporting requirements include:

- Regulatory requirements: EU Taxonomy, Corporate Sustainability Reporting Directive (CSRD), The Bank of England’s 2021 Biennial Exploratory Scenario (BES), Financial Conduct Authority’s Discussion Paper on Climate Change and Green Finance, US Executive Order on Climate-Related Financial Risk – The Federal Insurance Office (CIO) of the U.S. Department of the Treasury, Security and Exchange Commission (SEC) is expected to release a response to the EU’s CSRD

- Investor-driven requirements: The Global Reporting Initiative (GRI), The Sustainability Accounting Standards Board (SASB), The Carbon Disclosure Project (CDP), and The Task-Force for Carbon-related Disclosures (TCFD)

- Peer-driven requirements: Net Zero Alliance, Principles for Sustainable Insurance (PSI)

Emerging regulatory requirements have resulted in one of the most significant increases in (re)insurer resource pressure that we have ever seen, requiring a massive overhaul of data strategy and ownership. In turn, broader organisational challenges are arising regarding ESG data ownership and governance, along with challenges around data collection, consolidation, validation, and reporting. Unconsolidated and fast-evolving sustainability frameworks lead to significant data standardisation challenges. Although we expect data standardisation to improve somewhat as a result of several leading sustainability frameworks agreeing to align their standards, organisations are nonetheless working tirelessly to address rapidly evolving standards.

Carbon accounting and Scope 3 Emissions requirements

Accounting for Scope 3 emissions poses a significant challenge for reinsurers in particular. Scope 3 requirements centre around emissions that are external to an organization – driven by customer or supply chain activity. In certain industries, calculating emissions from supply chains is relatively simple. For reinsurers, this equation is complex -- all downstream emissions (i.e., emissions generated by the use of the insurance products) must be estimated. We have yet to identify a technology solution that directly solves this challenge for the insurance industry.

Consumer demand for sustainability

Younger consumers are becoming more mindful of sustainability and are demanding more sustainable options; organisations are increasingly developing carbon-neutral products and practices in response. This trend is likely to extend into insurance products in the coming years. As consumers demand sustainable insurance products, insurers will be required to develop innovative products. Embedded offsetting, as seen with Marshmallow’s partnership with ClimatePartner, is just one example.

Nature-based assets

SCOR has signed the Finance for Biodiversity Pledge, with the aim of onboarding biodiversity in its investment decisions and widening its sustainable investing approach. We believe that thinking about climate change is no longer possible without considering the impact of biodiversity loss on the environment. As responsible investors, we plan to look for opportunities to partner with companies at the intersection of (re)insurance and initiatives linked to climate change and biodiversity risks and opportunities.

************

We plan to publicise a summary of our ESG investment thesis this autumn, which will include a deeper dive into key trends, an overview of how (re)insurers are approaching sustainability, and more details on our investment and partnership thesis in this space.

In the meantime, we would welcome feedback on our ESG investment principles or the opportunity to meet new companies working on ESG-related solutions. We continue to welcome cold emails, approaches from first-time founders, and the opportunity to build relationships and share insights with founders whose businesses may not yet be at the right stage for us.