- FR

- EN

In March 2021, we wrote about Ventures 2.0, the continuation of our Ventures strategy. As we enter 2022, we reflect on notabl e events and partnerships that lay the groundwork for an exciting year ahead. We thank our partners and colleagues who have contributed to the roll out of Ventures 2.0 and look forward to an exciting 2022.

P&C Ventures’ 2021 highlights

2021 was a remarkable year for the start-up ecosystem. It was also a year of significant change and growth for our team. A key pillar of our approach is to be active supporters of the companies we work with, and we would like to take the time to highlight some of the shared successes and key moments of 2021.

- We increased the size of our portfolio by 50% in 2021, welcoming new partners including Measured and Snapsheet. We made our first investment in Latin America and anticipate a first investment in APAC in Q1 2022.

- Our portfolio companies collectively raised 250 million USD in 2021 alone, supported by best-in-class investors. Doma (previously States Title), an early thesis 1 company, went public in July, while Marshmallow reached unicorn status after raising an 85 million USD Series B.

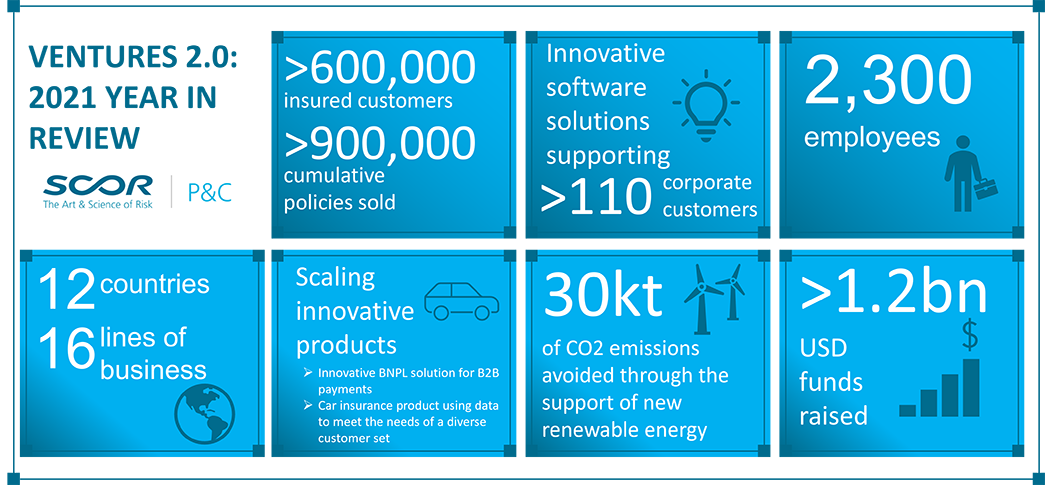

- Our portfolio companies have grown from ~1,200 to over 2,300 employees.

- 2021 saw our partners deliver on continued product and territory expansion, including Hokodo, continually growing their EU footprint, and Energetic, now supporting multiple project types across the solar landscape or similar. Supporting customers with personal lines and specialty lines products, our partners now serve >16 lines of business

- There were several examples of our portfolio companies joining forces, including this collaboration between Branch and Snapsheet.

- Our start-up partners continue to add value to both SCOR and our clients. Ventures leverages our network within the start-up ecosystem to build value-added relationships between our SCOR business partners / clients and start-ups. Examples of this in 2021 included:

- Ventures providing financial support for and active participation in POCs between clients and portfolio companies.

- Offering insurtechs a unique opportunity to present at SCOR’s US “Campus”, a learning and networking event open only to SCOR’s clients.

- The P&C Ventures team doubled in size as we were joined by Randy, Meghan and Kendall. Their broad experience as operators, cat modellers and management consultants diversifies our experience and increases the value we can bring to our partners.

- In September, we launched our investment and partnership ESG Principles which can be found here. As a team, we are committed to promoting sustainable principles and embedding ESG values into our investment strategy. We continue to deepen our investment thesis around key ecosystems such as ESG, pricing and modelling, etc. and will publish our ESG investment thesis later this quarter.

Venture Capital in 2021

Insurtech investment continued to grow in 2021 with nearly 2x more capital investment versus 20201. While our own data continues to demonstrate that many deals go unreported, sources estimate insurtech closed 2021 with 12+ billion USD invested globally and 650+ deals2. Dealflow increased by ~3x compared to 2020, driven by a new wave of specialty and commercial insurance solutions. Increased activity is expected to continue across 2022-2023, driven by the seven growth engines highlighted in our March 2021 post.

As insurtech continues to evolve, new trends emerge:

- We have observed an increase in start-ups solving complex commercial and specialty lines challenges, compared to a prior focus on personal lines such as auto, home, etc. We have seen several start-ups in commercial segments (e.g., D&O, excess casualty, industrial workers comp) as well as niche specialty lines (e.g., energy transition, climate risks, industry 4.0). We expect this trend to continue through 2022.

- Insurtech will continue to crossover to fintech, with insurance products supporting buy now, pay later (BNPL), credit, and financing. We believe that insurance adds value and improves the sustainability of trade finance and BNPL models (e.g., by covering dilution risk, offering extended warranty, or providing a credit insurance backstop). These solutions are commonly linked to growth in the marketplace economy, where the current merchant-facing payments value chain is largely fragmented, impacting customer experience and merchant economics. We expect that merchants will likely turn to payment solutions that provide a seamless experience and drive down overall costs as part of the broader adoption of the merchant assistance layer. In our view, the only way to accomplish both is with a full-stack business mode that allows new players to control financing, credit, collections and insurance to ensure a consistent customer experience and to drive down cost. This full-stack ecosystem also provides significant opportunity to offer other insurance products.

We are excited to work with new founders in 2022.

1 Source: PitchBook

2 Source: PitchBook