- FR

- EN

SCOR Ventures

Four years after SCOR launched our Venture teams (P&C Ventures and L&H Ventures) and eighteen months after announcing Ventures 2.0, we are excited to announce our next phase, Ventures 2.5.

Four years after SCOR launched our Venture teams (P&C Ventures and L&H Ventures) and eighteen months after announcing Ventures 2.0, we are excited to announce our next phase, Ventures 2.5. Going forward, the P&C Ventures and L&H Ventures mandates are combined into a single practice. The SCOR Ventures team will lead investments and partnerships with early-stage companies working on solving problems across all (re)insurance lines of business. In this post, we share a short summary of what this will mean in practice for founders and teams working with us.

SCOR Ventures: our approach

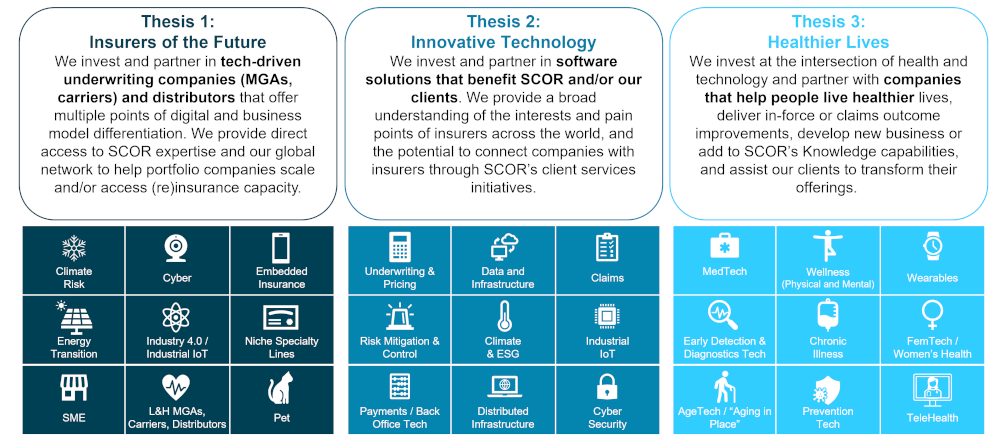

The integrated Ventures practices combine the venture market access, speed of execution, and know-how of P&C Ventures for MGA, carrier, and software investments and partnerships with L&H Ventures’ HealthTech expertise. The new approach will allow us to further accelerate and align deals across L&H and P&C. We invest and partner across three thesis areas:

SCOR Ventures is:

- a global team built on a mix of insurance, operating and investment expertise:

We will also be hiring an analyst in the near future, please contact us if interested.

- investing in the ‘Insurers of the Future’, software solutions that benefit SCOR and/or our clients, and companies that help people live healthier lives, building on the existing investment theses of P&C Ventures and L&H Ventures (previously led by Bernd Mueller)

- Thesis 1: we invest in the ‘Insurers of the Future,’ tech-driven underwriting companies (MGAs, carriers) that offer multiple points of digital and business model differentiation. We will now include L&H MGA / carrier models in Thesis 1.

- Thesis 2: we invest in software solutions that benefit SCOR and/or our clients. We provide a broad understanding of the interests and pain points of insurers across the world, and the potential to connect companies with insurers through SCOR’s client services initiatives.

- Thesis 3: We invest at the intersection of health and technology in companies that help people live healthier lives, deliver in-force or claims outcome improvements, develop or provide access to new business, add to SCOR’s knowledge capabilities, and assist our clients to transform their offerings.

- Thesis 1: we invest in the ‘Insurers of the Future,’ tech-driven underwriting companies (MGAs, carriers) that offer multiple points of digital and business model differentiation. We will now include L&H MGA / carrier models in Thesis 1.

- backing founders at Seed to Series B. We typically seek greater than 5% ownership at first investment, which may include a board seat (we have led or co-led half of our investments to date). Our investment is intended to make SCOR a meaningful contributor but leave founders room to manage their cap table. We look for a long-term investment and / or commercial relationship but do not seek a fast exit or to ultimately acquire portfolio companies.

- investing globally, focused on key markets in North America, EMEA and LATAM, with selective deployment in APAC and Africa.

- integrated with the wider SCOR business. SCOR’s core business has experts in nearly every country, line of business, and functional area. Direct access to the entirety of SCOR’s capabilities brings unique added value to our portfolio companies, and we are excited to extend this expertise to HealthTech. We will also work closely with our colleagues in SCOR Partners, a newly formed business unit at SCOR dedicated to developing and delivering client solutions, including but not limited to David Suetterle and Henri Douche.

- offering a genuine partnership approach. We are active supporters of the companies we work with, assisting with technical input, recruitment, capital optimisation and more. We bring value to our portfolio companies by connecting them with other partner companies, as well as with founders and distribution leads in our network.

SCOR Ventures: how to reach us

You can contact us via LinkedIn, our website, or email. We continue to be committed to offering transparency and accessibility for all founders, regardless of whether we have already begun to work with them. We welcome cold emails, approaches from first-time founders, and the opportunity to build relationships and share insights with founders whose businesses may not yet be at the right stage for us.

We are excited to work with you and particularly excited to extend our relationships with founders and investors working at the intersection of health, risk and technology.