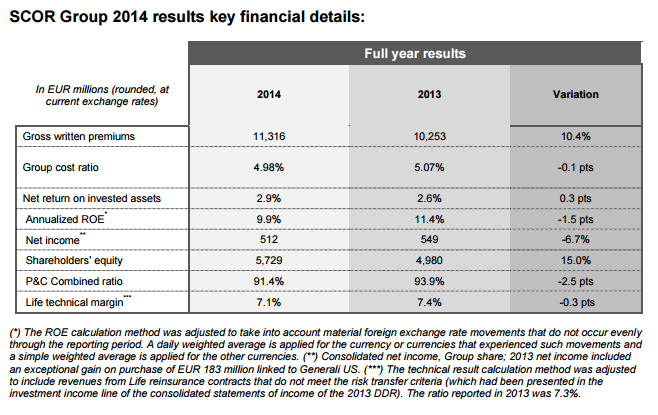

- Gross written premiums reach EUR 11,316 million, up 10.4%1 compared to 2013 (10.8% at constant exchange rates). This is driven by the Generali US contribution following its acquisition by the Group in October 2013, and by the growth of both SCOR Global Life in Asia and Financial Solutions & Longevity, and SCOR Global P&C:

- SCOR Global P&C gross written premiums increase by 2.7% at constant exchange rates (+1.8% at current exchange rates) to EUR 4,935 million;

- SCOR Global Life gross written premiums reach EUR 6,381 million, up by 5.5% at both constant and current exchange rates on a pro-forma basis.

- SCOR Global P&C delivers excellent 2014 technical profitability with a net combined ratio of 91.4%, compared to 93.9% in 2013.

- SCOR Global Life’s 2014 technical margin stands at 7.1%, compared to 7.4% on pro-forma basis in 2013, reflecting the ongoing evolution of the underlying mix, as disclosed in “Optimal Dynamics”.

- SCOR Global Investments achieves a 2.9% return on invested assets thanks to its active portfolio management and the evolution of its investment portfolio.

- In 2014, the Group generates a strong operating cashflow of EUR 894 million, with strong contributions from both SCOR Global P&C and SCOR Global Life.

- Net income stands at EUR 512 million in 2014, an increase of 40% compared to 2013, excluding an exceptional gain on purchase of EUR 183 million linked to Generali US. Return on equity (ROE) stands at 9.9%2.

- Shareholders’ equity reaches EUR 5,729 million at 31 December 2014, compared to EUR 4,980 million at 31 December 2013. After distribution of EUR 243 million in cash dividends, book value per share increases by 15% to EUR 30.60 as at 31 December 2014, compared to EUR 26.64 as at 31 December 2013.

- SCOR’s solvency ratio, as defined by the 2014 internal model3, remains marginally above the optimal range.

- SCOR’s financial leverage stands at 23.1% as at 31 December 2014. The placement of two perpetual subordinated debts of EUR 250 million and CHF 125 million4 in 2014 demonstrates the Group’s active management of its liabilities.

- SCOR will propose to the Annual General Meeting an increased dividend of EUR 1.40 per share for 2014, up from EUR 1.30 for 2013, representing a payout ratio of 51%. The proposed ex-dividend for 2014 will be set at EUR 1.40 on 5 May 2015 and the dividend will be paid on 7 May 2015.

1 On a published basis; on a pro-forma basis gross written premium growth is 3.8% (4.2% at constant exchange rates).

2 The ROE calculation method was adjusted to take into account material foreign exchange rate movements that do not occur evenly through the reporting period. A daily weighted average is applied for the currency or currencies that experienced such movements and a simple weighted average is applied for the other currencies.

3 This estimate is based on the 2014 internal model taking into account the estimated available capital at year-end 2014 divided by the estimated SCR as at that date, allowing for planned business in 2015. The internal model will be subject to a review and approval process conducted by the ACPR over the coming months. The estimate based on the 2015 model will be provided with the Q1 2015 publication.

4 See press releases of 25 September 2014 and 24 September 2014 respectively.