-

Sustainability At The Core of our Strategy

SCOR's responsibility to our stakeholders and society is not just a feature of how we operate - it's who we are.

-

Key Documents

-

2024 Universal Registration Document

-

2024 Activity Report

-

2024 Sustainable Business Report

-

2025 Sustainability Policy

-

-

Sustainable Framework

SCOR has an integrated governance system that takes into account the environmental, social and governance-related impacts, risks and opportunities of SCOR’s business activities. This system is structured around five core pillars:

- a general reference framework based on international standards and initiatives and SCOR’s raison d’être;

- a dedicated and robust governance framework under the supervision of the Board of Directors, with input from its specialized Committees;

- a risk management system that builds on SCOR’s analysis and monitoring of megatrends and the associated risks;

- a framework to implement a variable compensation linked to sustainability criteria;

- integrated initiatives laid out in annual action plans.

Our sustainability strategy covers a range of topics, including relations with the Group’s stakeholders, the integration of environmental, social and governance concerns into reinsurance and investment activities, environmental performance with regard to our operations, and the areas covered by the #WorkingWellTogether program. #WorkingWellTogether is a staff-led initiative that comprises all of SCOR’s staff-led actions relating to wellbeing and societal engagement.

-

Integrating ESG Issues

SCOR is squarely focused on society’s key environmental, social and governance (ESG) challenges. Our teams systematically identify, analyze and assess megatrends and emerging risks, looking at them also from the perspective of development opportunities. We help to build resilience through risk identification, analysis, transfer and sharing.

Good governance plays a crucial role in achieving our strategic objectives and contributing to the resilience of societies. SCOR has an integrated governance system that considers the environmental, social and governance-related impacts, risks and opportunities of the Group’s business activities.

-

Guiding Principles

SCOR is a longstanding participant of the United Nations Global Compact, integrating its 10 principles – on human rights, international labor standards, environmental protection, and the fight against corruption – within a framework tailored to our sphere of influence. SCOR has also contributed to the formulation of the Principles for Sustainable Insurance and adheres to them closely, as well as to the Principles for Responsible Investment.

-

We acknowledge the undeniable relevance of the Sustainable Development Goals (SDGs) to our business. In particular, we are committed to reducing climate risk by helping to make companies more resilient, promoting the adoption of appropriate practices and principles, fostering cooperation, and encouraging good governance, integrity and accountability. Our own Sustainability Policy reflects our longstanding and ongoing commitment to achieving climate resilience. It provides a dynamic framework for managing the Group’s environmental impact – both direct and indirect – and provides a strategy for addressing the many risks and opportunities posed by climate change.

-

At SCOR we encourage the adoption of social and environmental criteria by each and every member of the Group.

-

Fighting Climate Change

At SCOR we manage and mitigate climate risk in a holistic manner, encompassing assets and underwriting liabilities within an approach that includes:

- assessing and addressing climate-related risks and opportunities

- contributing to the understanding of climate-related risks, e.g. by developing and improving our catastrophe modeling tools and through partnerships with scientific institutions for the modeling of climate events

- monitoring the carbon footprint of SCOR’s invested assets portfolio and measuring its alignment with the 2°C scenario

- assessing the exposure of the investment portfolio to climate transition risks

- investing in solutions for climate risk adaptation

- contributing to the transition towards a low-carbon economy through insurance coverage products and investment in renewable energy projects.

-

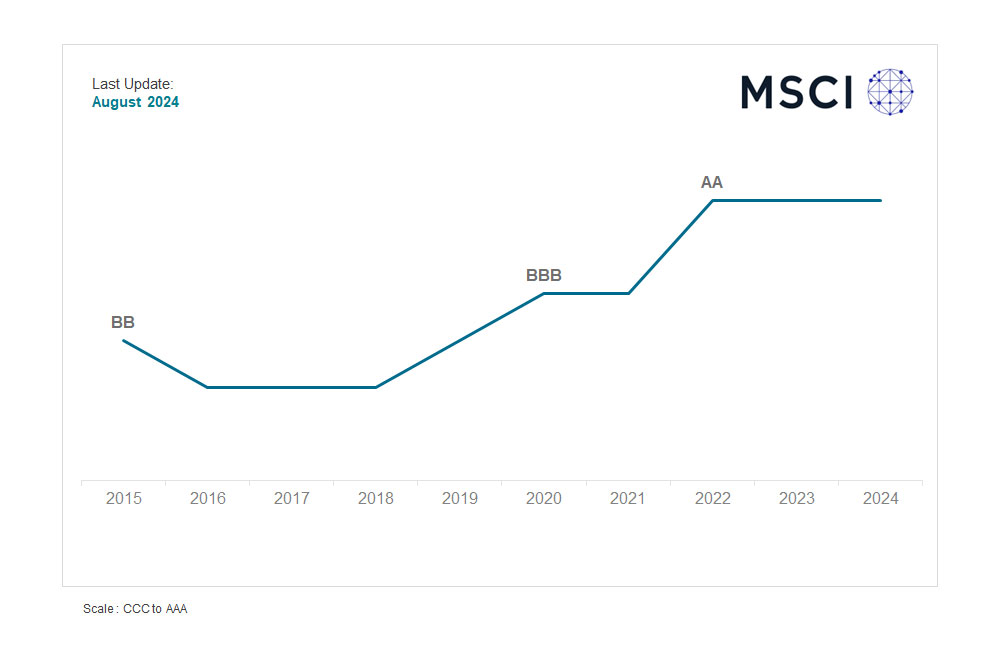

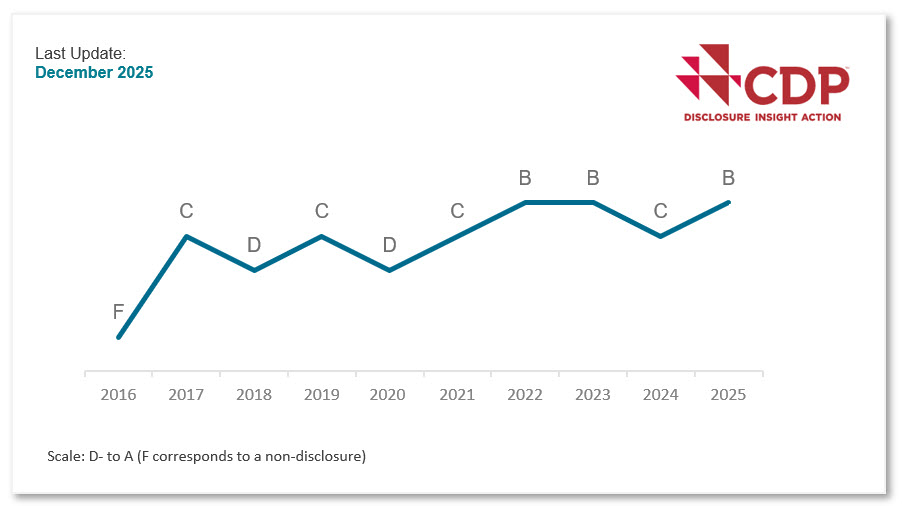

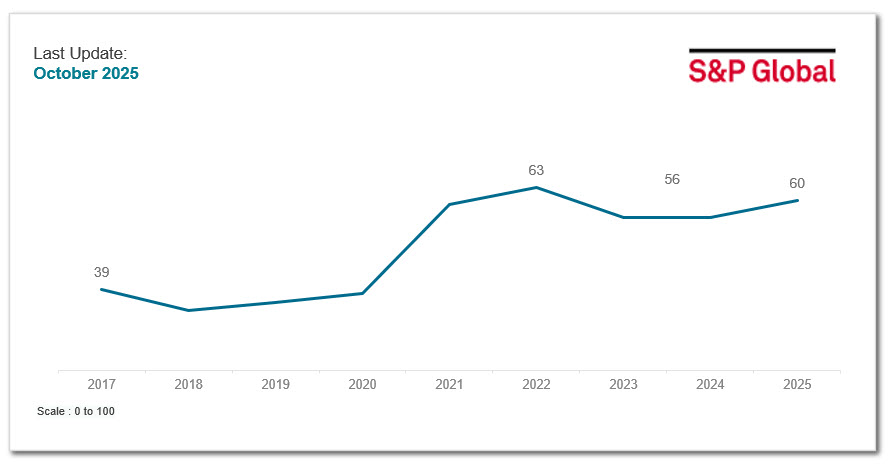

ESG Ratings

-

More about our Sustainability initiatives:

-

Sustainable Underwriting

-

Sustainable Investments

-

Sustainable Operations

-

Sustainable Commitments and Stories

horizontal -