-

Underwriting and claims management

-

Our Life & Health underwriting experts help clients to make the most effective risk decisions in their underwriting of applicants, with strong selection strategies in the medical, non-medical and financial fields.

SCOR’s risk management and claims services experts work with clients to help identify high risk levels, spot substandard risks, determine the conditions under which to accept certain risks, and limit adverse selection.

Underwriting management

Today’s underwriting or health assessment process remains one of the major focuses for improvement in the purchasing of Life & Health insurance. We are well ahead in the revolution that is currently reengineering the underwriting process, which enables us to create innovative protection products for consumers.

With Velogica, SCOR Digital Solutions’ state-of-the art suite of automated underwriting solutions, we provide customized solutions by market to deliver superior customer journeys by smoothing the pathway to purchase. Highly sophisticated automation mimics the thought processes of human underwriters, so that a significant proportion of new business can be issued automatically with no need for manual intervention.

To learn more about Velogica, click here

One of the challenges insurance companies are facing is the fact that health data from their customers is everywhere (doctor records, lab results, pharmacies, wearable devices), and this data is neither standardized, nor always digital.

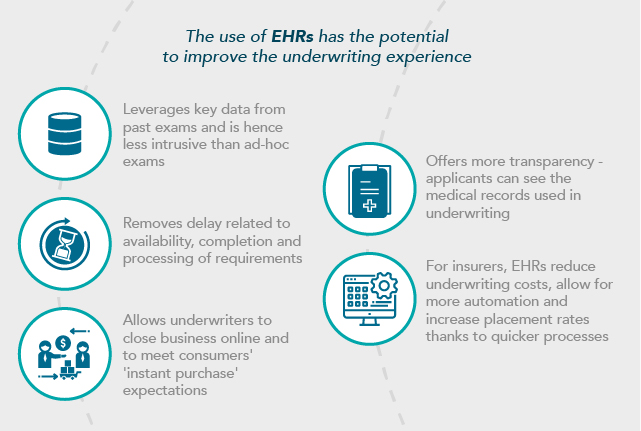

As information becomes available electronically, Life insurers have more opportunities to make instant use of data from electronic health records (EHR) in the underwriting experience, thus improving speed, price, inclusiveness, and transparency.

To learn more about the use of EHRs, click here

Our teams, together with our colleagues from SCOR Digital Solutions around the world, develop interfaces for their clients that improve and accelerate the underwriting process.

Predictive models are beginning to replace rules-based elements of underwriting.

- Traditional rules-based approaches start with assumptions and predict outcomes

- Predictive-model based strategies start with outcomes and use modeling techniques to identify data characteristics most likely to produce those outcomes

In Asia, the SCOR China team has launched an innovative underwriting initiative using predictive modeling and electronic health records.

TKEyes (the Thousand Kilometer Eyes System) leverages machine learning and multiple data sources to come up with individual scores, improving the Life insurer’s operational efficiency and the overall customer journey.

Focus on U.S. Predictive Underwriting

-

In the U.S., prediction and prevention have emerged as core values for Life insurance. Prediction is currently taking the shape of underwriting models that can improve efficiency and more accurately tune client pricing. Prevention is emerging not only as a tool to improve the bottom line but also as a way to engage end consumers about their health and wellbeing. Part of SCOR’s exploration into the future of reinsurance focuses on underwriting.

-

The U.S. Underwriting Solutions team has also developed tools to support clients with more efficient facultative underwriting submissions and effective monitoring of accelerated underwriting programs:

FAST (Facultative Assessment & Selection Tool) instantly assesses qualifying medical impairments with rating of Table 4 or better, potentially improving the client rating on the case. Preferred rating is available on Non-Tobacco or Tobacco classes. U.S. underwriters may access the platform either with the SOLEM Americas Underwriting Manual or via two standalone site versions, and they only need to enter their internal policy number to verify a FAST simplified offer acceptance. Email FAST@scor.com for more information.

SMART (SCOR Monitoring & Acceleration Reporting Tool) uses visualizations from our data analytics platform to provide rigorous monitoring and to identify actions quickly to improve accelerated underwriting programs when needed. The dashboard helps U.S. underwriters understand how their companies are performing against peers and against benchmarks. Contact James Atkins or Thomas Ballweg for more information.

Claims Management

SCOR’s Life & Health business also strives to be at the forefront of the claims reengineering revolution.

In markets where we write disability insurance, making the process easier for applicants can help insurers to better manage their claims. Intervening early in the claims process may also positively impact the individual’s recovery, as well as making a financial difference to the claim value.

Our teams create tailor-made solutions that take our clients’ constraints into consideration. For example:

- In Australia, our Best Practice Claims Management model and Claims Rules Engine represent a step towards migrating from claims processing to human support (see below).

- In France, our e-claims solutions provide a tailor-made approach to gathering claims information.

- In Germany, we provide a claims prevention and recovery service linked to short- and long-term mental health disability.

SCOR’s claims rules engine

Improving the customer claims journey & reducing insurers’ time & expense through a simple and comprehensive digital experience.

VClaims is an award-winning digital claims solution tailored for the life and health market, leveraging SCOR’s leading reinsurance risk knowledge and experience.

Learn more about VClaims Download the brochure

Focus on managing disability claims in Australia

-

We have designed a best practice claims management model to assist our clients to be more agile in the way claims are managed, by aligning philosophies and driving consistent customer experience.

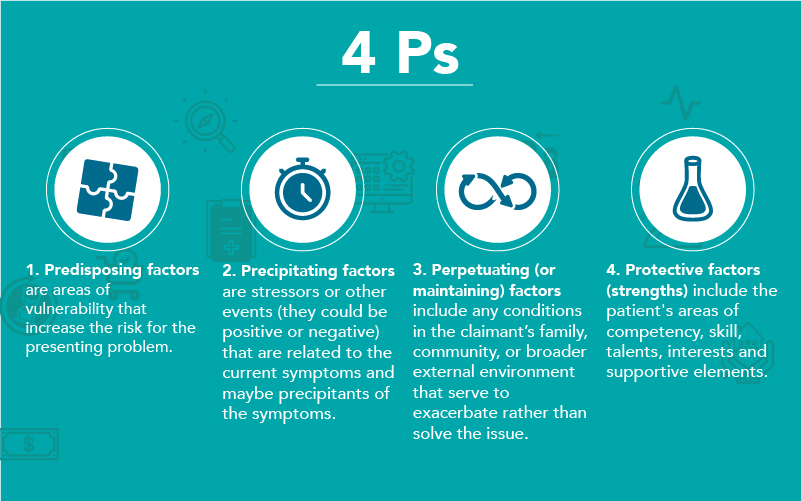

Using a claims management model helps insurers to understand their claimants as more than just a diagnostic label or medical condition. Our model combines biological, psychological, and social factors to guide treatment and prognosis, by asking about the “4 Ps”: -

The claims management model helps to provide a new understanding of the claim and the context in which claimants are considered.

SOLEM – our Underwriting Manual powered by Data and Knowledge

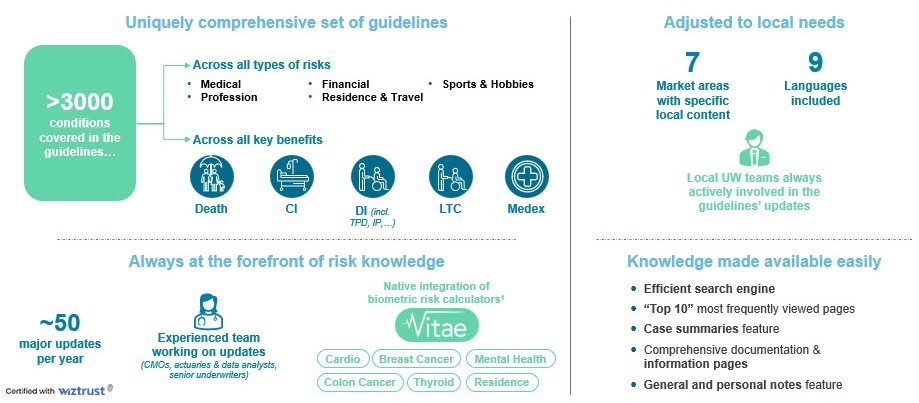

With SOLEM, our clients can assess any type of risk, across all lines of business (death, critical illness, IP, TPD, disability, Medex, LTC etc.). Covering more than 3,000 conditions across a wide range of different factors (medical, occupation, sports, financial, residence & travel…), SOLEM offers some of the most comprehensive guidelines in the market.

SOLEM is constantly updated by our team of doctors, local and global underwriters, actuaries, data scientists, all working hand in hand to monitor the latest research and data and turn it into relevant, inclusive, evidence-based guidelines, aiming to cover as many people as possible, for the fairest possible Underwriting decision.

SOLEM is also powered by Tech, with our pioneering range of Vitae Calculators, leveraging machine learning techniques and large databases to further enhance Underwriting:

- Vitae Cardio

- Vitae Breast Cancer

- Vitae Mental Health

- Vitae Colon Cancer

- Vitae Thyroid

- Vitae Travel & Residence

-

-

Sharing knowledge: client trainings

-

For almost 50 years, our SCOR Campus training program has been dedicated to sharing knowledge with our clients throughout the world.

With a view to consolidating our long-term business relationships, we offer our commercial partners themed seminars, conferences and webinars, with a focus on underwriting and claims management. -

Contact Us!

For any questions about the tools and solutions set out above, please get in touch with your local contact