The growing demand for insurance education

And insurers’ role in driving insurance literacy

January 14, 2022

We live in a risky – yet largely underinsured – world and more and more experts are placing the blame on a general lack of insurance literacy. If people don’t understand the risks they face or how insurance can protect them, how can they be expected to choose the right coverage for their needs?

In October 2021, SCOR’s subsidiary ReMark released the first ever global survey addressing consumers’ knowledge of, and confidence with, life and health insurance. As part of ReMark’s annual Global Consumer Study (GCS), this survey was able to identify the gaps between respondents’ self-reported knowledge and their actual understanding of insurance.

Not only does the survey offer insurers valuable insights about customers’ unmet needs, but it also proves that customers are eager to learn more.

Backed with these insights, ReMark and SCOR’s Life & Health business unit are taking the first steps to explore the role insurance education can play in building a more resilient society.

Why is insurance literacy important?

It is well-established that when people are more financially educated, they make better financial decisions and the same is true of insurance. Unfortunately, the solution isn’t a simple question of providing additional information during the buying process. Firstly, because many people won’t be motivated to buy insurance without first understanding why it is needed. Secondly, because we have to untangle misconceptions about financial security, personal health, and risk and consciously deconstruct cognitive biases faced throughout the insurance journey.

As insurance professionals, we can take it for granted that the need for life and health insurance is evident: it protects our health and wellbeing through preventative care and proactive treatment and ensures the financial wellbeing of our loved ones in the event of an unexpected death. However, for many people the purpose of insurance isn’t so self-explanatory and to make matters worse, many people admit that they don’t understand insurance disclosures and often don’t even read them1.

Another formidable hurdle comes with how people perceive risk and the tendency to underestimate low-probability, high-impact events2. This “nothing bad will happen to me” mentality is caused by optimism bias, an inclination to overestimate the likelihood of good things happening and underestimate the likelihood of bad things happening, which can lead to people misjudging the importance of insurance.

The market-specific insights provided by ReMark’s GCS are a necessary first step in understanding how to overcome these misconceptions and biases.

The First Global Insurance Literacy Survey

Since the topic of insurance literacy has only recently sparked conversation, existing research is sparce. ReMark was the first to tackle this question on a global scale with nearly 13,000 respondents from 22 countries.

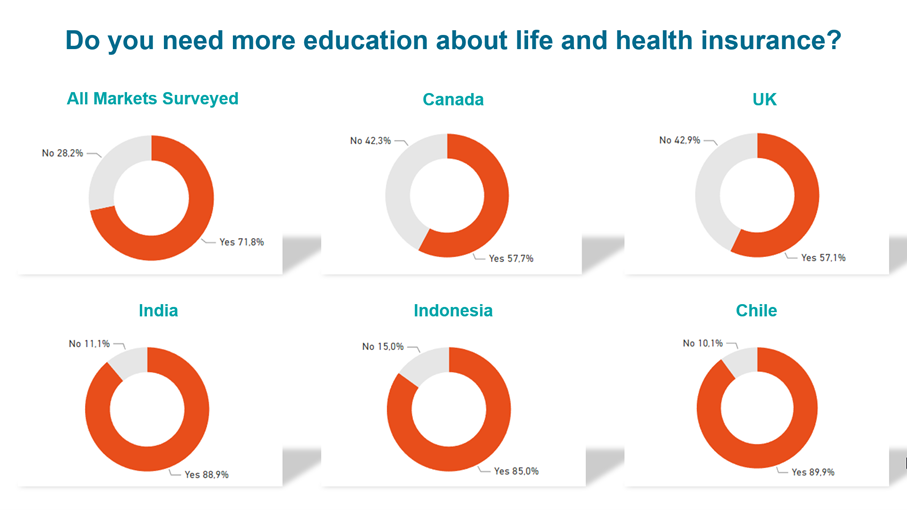

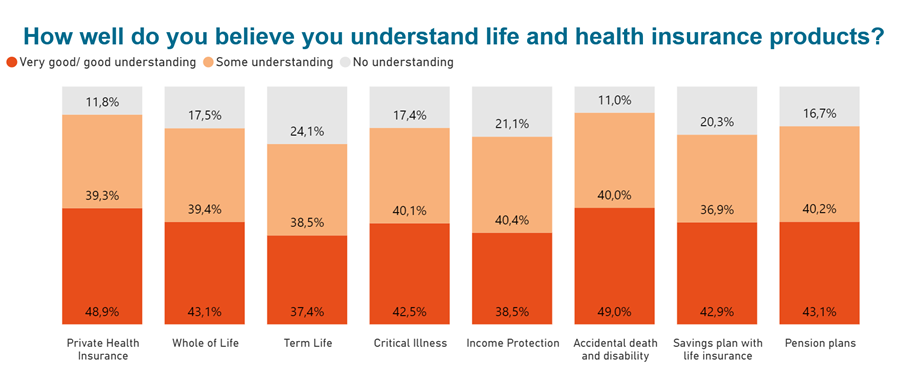

A majority of respondents (94%) believe they have at least some knowledge of life and health insurance products and 61.2% say they feel confident applying for a life or health insurance policy themselves. Below is a breakdown of respondents’ confidence when it comes to specific life and health insurance products.

To test respondents’ actual knowledge, ReMark asked a series of questions on the basic principles of insurance including underwriting, risks and needs. Overall, the results seem promising: the average score was 6.59 out of 10, meaning respondents answered two-thirds of the questions correctly. But when we look at the data more closely, a different picture begins to emerge.

Established markets generally scored higher, with Canada (7.36), Sweden (7.24), and the UK (7.2) leading the way. On the other hand, several growth markets showed a huge disparity between their confidence and actual knowledge: the three countries with the lowest scores (India, China, and Indonesia, scoring 5.43, 5.65, and 5.83 respectively) are among those with the highest proportions of respondents claiming to have a very good knowledge of life and health insurance.

We invite you to take a closer look

at the results with ReMark’s interactive dashboard

Next Steps for SCOR and ReMark

These findings show that there is still work to be done to empower consumers to make better financial and insurance decisions. ReMark points out that this is a tremendous opportunity for the insurance sector, offering potential benefits to both consumers and insurers, as well as helping to create more resilient societies as a result of greater penetration of insurance coverage.

While ReMark was finalizing these findings, the topic of education was already on SCOR’s radar. The results of an internal survey at SCOR’s UK office suggested that many of today’s students are not receiving important foundational financial education. This led to a partnership with Young Enterprise, a charity teaching UK students how to make informed financial decisions. Not only is SCOR now backing a local school to receive Young Enterprise’s existing financial education curriculum, but those spearheading the effort believe that the collaboration could feasibly lead to an outlet for fostering greater insurance literacy in the future.

“Young Enterprise has already produced a lot of financial education material, but what they’re missing is insurance focused material,” says Vicky Gardner, Head of EMEA Data Analytics at SCOR’s Life & Health business unit and one of the employees behind the recent partnership. “That could be something that SCOR really helps develop in the future.”

Ongoing work at ReMark has outlined four key steps that show the ample need for such partnerships in order to build a more insurance literate future:

- Benchmarking the current level of insurance literacy

- Raising awareness of the importance of insurance literacy

- Coordinating with companies, academics, and others researching the topic

- Educating consumers

This isn’t a change the industry is going to see overnight, but it is clear that SCOR, ReMark, and our insurer partners will have a role to play in driving progress toward each of these crucial milestones.

Read more:

1. https://virtusinterpress.org/IMG/pdf/rgcv10i4p2.pdf

2. https://www.researchgate.net/publication/228319777_Consumers%27_Insurance_Literacy