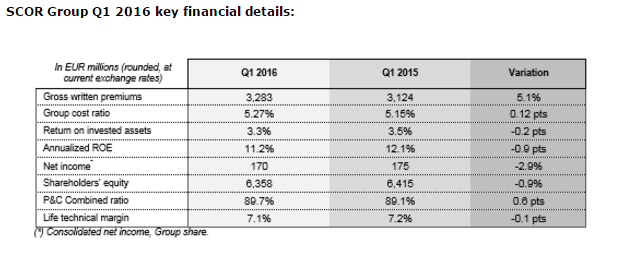

- In the first quarter 2016, SCOR continues to deliver excellent results, with resilient technical profitability and strong net income generation, along the same lines as in 2015.

- Gross written premiums reach EUR 3,283 million, up 5.1% at current exchange rates compared to 2015 (+5.0% at constant exchange rates), with:

- a strong contribution from SCOR Global Life, with gross written premiums reaching EUR 1,907 million over the quarter (+10.5% at current exchange rates and +9.9% at constant exchange rates);

- a 1.6% decrease in SCOR Global P&C gross written premiums at current exchange rates (-1.1% at constant exchange rates), which stand at EUR 1,376 million, affected by the cancellation of the division’s participation in a Lloyd’s syndicate as well as by lower activity on the Aviation book of business. Excluding these impacts, premium growth would have been 2.7%.

- SCOR Global P&C records very strong technical profitability with a net combined ratio of 89.7% in the first quarter of 2016, in an environment of low natural catastrophe losses.

- SCOR Global Life records a strong technical margin of 7.1% in the first three months of 2016, constantly delivering above the “Optimal Dynamics” assumption of 7.0%.

- SCOR Global Life’s Market Consistent Embedded Value (MCEV) reaches EUR 5.6 billion at the end of 2015, up 17% compared to 2014.

- SCOR Global Investments achieves a solid 3.3% return on invested assets, while maintaining its prudent portfolio management.

- Group net income reaches EUR 170 million in Q1 2016, broadly stable with the Q1 2015 net income. The annualized return on equity (ROE) stands at 11.2% or 1,111 bps above the risk-free rate1.

- Shareholders’ equity stands at EUR 6,358 million at 31 March 2016, compared to EUR 6,363 million at 31 December 2015. This translates into a book value per share of EUR 34.13 at 31 March 2016, compared to EUR 34.03 at 31 December 2015.

- SCOR’s financial leverage stands at 27.6% as at 31 March 2016, temporarily above the range indicated in “Optimal Dynamics”. This is the result of the successful placement of EUR 250 million dated subordinated debt, issued with a coupon set at 3.25% in June 2015, and the placement of the dated subordinated debt of EUR 600 million2 to refinance the undated subordinated debt of CHF 650 million callable in August 2016. The financial leverage adjusted for the intended calls of the two debts callable in Q3 2016 would stand at approximately 20.6%3.

- SCOR’s estimated solvency ratio at 31 March 2016, adjusted for the intended calls of the two debts callable in Q3 2016, stands at 202%4, within the optimal solvency range of 185%-220% as defined in the “Optimal Dynamics” plan.

1 Three-month risk-free rates.

2 See press releases of 2 June 2015 and 2 December 2015 respectively.

3 Adjusted financial leverage ratio would be approximately 20.6% assuming the repayment of the CHF 650 million and EUR 257 million subordinated debts callable in Q3 2016, subject to the evolution of market conditions and supervisory approval.

4 The estimated adjusted solvency ratio of 202% allows for the intended calls of the two debts callable in Q3 2016 (the 6.154% undated deeply subordinated EUR 257 million notes callable in July 2016 and the 5.375% fixed to floating rate undated subordinated CHF 650 million notes callable in August 2016), subject to the evolution of market conditions and supervisory approval. The estimated solvency ratio based on Solvency II requirements is 222% at 31 March 2016.