Body

SCOR delivers strong results during the first quarter of 2014, confirming the dynamism of its franchise.

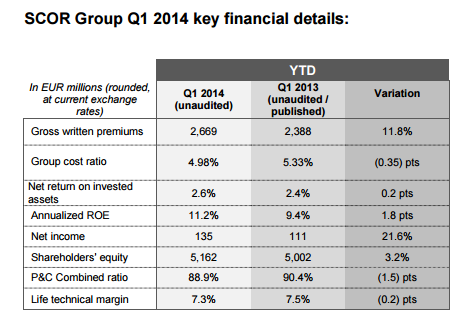

- Gross written premiums stand at EUR 2,669 million, up 14.8% at constant exchange rates (+11.8% at current exchange rates), driven by healthy SCOR Global P&C renewals, major new contracts signed by SCOR Global Life and the Generali US contribution:

- SCOR Global P&C gross written premiums increase by 3.6% at constant exchange rates to EUR 1,202 million;

- SCOR Global Life gross written premiums increase by 26.0% at constant exchange rates to EUR 1,467 million, notably supported by the Generali US acquisition. Pro-forma constant currency growth is 6.9%, with underlying growth driven by new contracts signed in Asia, the UK and the Iberian Peninsula.

- SCOR Global P&C’s Q1 2014 net combined ratio stands at 88.9%, compared to 90.4% in Q1 2013. This excellent ratio reflects the further improved attritional ratio. It also benefits from the low level of natural catastrophes, which have only contributed 2.1 points compared to the cat budget of 7 points indicated in “Optimal Dynamics”.

- SCOR Global Life’s Q1 2014 technical margin reaches 7.3%, compared to 7.4% on a pro-forma basis in Q1 2013. This strong performance trends towards the “Optimal Dynamics” assumptions and reflects the ongoing change in the portfolio mix.

- SCOR’s integration of the ex-Generali US is finalised and the Group has repaid in advance the USD 228 million (EUR 166 million) bridge loan used to finance the acquisition.

- As announced today, SCOR Global Life’s 2013 embedded value reaches EUR 4.5 billion, +29% compared to 2012.

- SCOR Global Investments maintains its prudent asset management, whilst continuing to progressively increase the duration of the portfolio. SCOR Global Investments records a return on invested assets of 2.6% for the first quarter 2014.

- Shareholders’ equity stands at EUR 5,162 million at 31 March 2014, up 4% versus EUR 4,980 million at 31 December 2013. Book value per share increases to EUR 27.49 at 31 March 2014 (versus EUR 26.64 at 31 December 2013).

- SCOR’s net income reaches EUR 135 million in the first quarter 2014, compared to EUR 111 million in the first quarter of 2013, up 21.6%. On an annualised basis, the return on equity (ROE) reaches 11.2% (9.4% in Q1 2013), well in excess of the “Optimal Dynamics” target of 1,000 basis points above risk-free rate.

- SCOR continues to provide its shareholders with a consistent dividend policy: proposed 2013 dividend of EUR 1.3 per share1, +8% compared to 2012.

- SCOR estimates its solvency ratio to be in the upper end of the optimal range of 185-220% defined in “Optimal Dynamics”.

- SCOR’s financial leverage stands at 20.8% at 31 March 2014, below the 25% ceiling defined in “Optimal Dynamics”.

With successful new initiatives over the first quarter, SCOR continues to strengthen its footprint and position among global leaders of the reinsurance industry, and pursues the implementation of “Optimal Dynamics”:

- Launch of a new fully collateralized sidecar, Atlas X Reinsurance Limited, a special purpose reinsurance vehicle in line with SCOR’s policy of pooling in its capital shield all the available capital protection tools;

- Launch of a Lloyd’s Managing Agency, providing structure and key management services to manage the affairs of SCOR’s syndicate, Channel 2015;

- Completion of key transactions in the longevity and financial solutions markets.

The consistency and effectiveness of SCOR’s strategy and management have been widely recognized by industry professionals, who have elected SCOR’s Chairman & CEO, Denis Kessler, to join the International Insurance Society’s Insurance Hall of Fame.

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “The results recorded by SCOR over the first quarter in terms of growth, profitability and solvency once again demonstrate the pertinence and strength of its strategic decisions. In the first quarter, the Group records significant progress in a number of areas, including solid growth in SCOR Global Life, strong January and April P&C renewals and the reinforcement of our platforms in the US and the London market. SCOR is firmly on track to achieve the profitability and solvency targets defined in “Optimal Dynamics”.

1 2013 dividend subject to approval of the Shareholders’ Annual General Meeting on May 6, 2014