SCOR Ventures continues SCOR’s long history of innovation

Our mission & offering

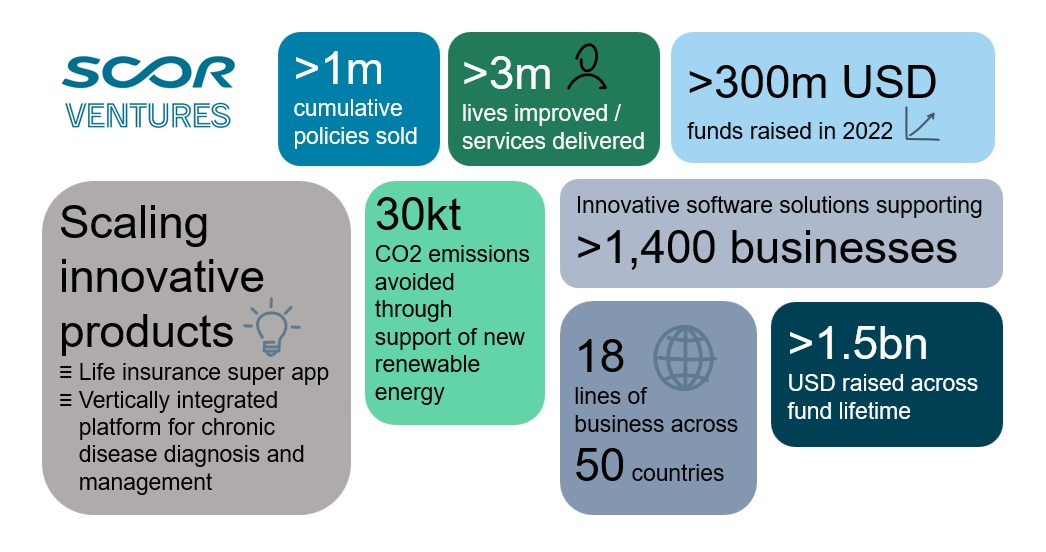

SCOR Ventures invests in companies applying fintech and new technology to legacy industries. We back founding teams working across multiple sectors including, but not limited to, direct applications of risk-driven business models (fintech, insurtech, digital health), to ecosystem businesses that offer risk products (e.g., employee benefits), and to software products that can be sold through the global risk network (FinOps, climate tech, cybersecurity, industrial software, etc.). Since our founding in 2017 we have developed a repeatable playbook leading to the formation of a portfolio with exceptional founders. We invest to form active and collaborative long-term relationships.

How we operate

- Geography: focused on key markets in North America, EMEA and LATAM.

- Stage and ownership: We invest Seed to Series B. We typically seek 7.5-12.5% ownership at first investment, which may include a board seat (we have led or co-led half of our investments to date). Our investment is intended to make us a meaningful contributor but leave founders room to manage their cap table. We look for a long-term investment relationship and do not seek a fast exit. SCOR does not look to ultimately acquire portfolio companies.

- Partnership approach: we are active supporters of the companies we work with, assisting with technical input, recruitment, capital optimisation and more.

- We believe in fewer, deeper relationships over the long term.

- We are flexible and collaborative, tailoring our investment approach to each company’s specific needs, in collaboration with other investors, clients, and partners.

- We bring value to our portfolio companies by connecting them to our diverse, global risk network, including, but not limited to, FI’s, industrials, (re)insurers, and brokers.

- We operate quickly and ego-free, and roll up our sleeves to support founders especially during times of adversity.

- We have a diverse set of team expertise and backgrounds that unlocks support across operations, strategy, risk, finance/fundraising, and talent.

Our ESG principles

To ensure alignment of values with our partners, we have embedded the following principles into our investment decision-making process:

We are also a committed member of VentureESG, a global community-based non-profit initiative made up of 300 VC funds and 90 LPs. Together, we are working to make ESG a standard part of due diligence, portfolio management, and internal fund management.

Meet the team

Will Thorne is the Head of SCOR Ventures. Will has a background in both (re)insurance underwriting and start-ups, and previously established SCOR’s Innovation team. He is a frequent advisor & angel investor in his personal capacity and was the founding chair of the Tech Nation UK Insurtech Board.

Kendall Miller Crocker is the Deputy Head of SCOR Ventures, based in New York. Kendall was previously an executive at an insurtech startup, and has a background in management consulting and corporate innovation for global clients.

Will Bird is a Principal based in Chicago. Will focuses on investment & partnership opportunities in the Americas. His previous experience includes corporate venture capital and strategy at a leading U.S. personal lines insurer.

Kathryn Byron is an Associate based in New York. Kathryn has a background in investment banking, corporate development, and venture capital across technology, fintech, health tech, climate, and media & entertainment.

More information

- SCOR Ventures: our next phase

- Ventures 2.0: 2021 Year in Review

- Embracing Sustainability Principles in (Re)Insurance Corporate Ventures

- Global insurtech growth is driving job creation and bringing new talent to the insurance sector

- SCOR partners with Snapsheet to bring best-in-class digital claims solutions to clients

- SCOR partners with Senseye to develop ROI LOCK

- Transformation through Innovation in the (Re)insurance Industry

- "Make InsurTech work for you" by Adrian Jones published by PCI Reporter

- "SCOR backs digital MGA Branch", Insurance Insider

- "Insurtechs are using digital infrastructure to deliver the products of tomorrow", SCOR Annual Conference 2019