Body

Following an exceptional series of major natural catastrophes, SCOR delivers strong results in 2017, once again demonstrating its shock-absorbing capacity. The Group’s strong growth, balanced between its Life and P&C divisions, along with its active robust capital shield and its prudent asset management, enable SCOR to reaffirm all the targets of its “Vision in Action” strategic plan for the remainder of the plan.

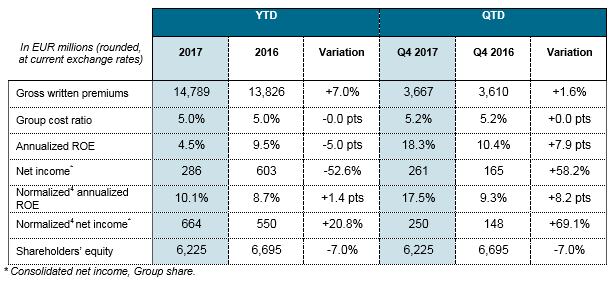

- Gross written premiums reach EUR 14,789 million in 2017, up 8.6% at constant exchange rates compared to 2016 (+7.0% at current exchange rates). This growth is well balanced between the Life division (+8.5% at constant exchange rates), which has seen continued expansion in Asia-Pacific and Financial Solutions, and the P&C division (+8.8% at constant exchange rates), which has benefited in particular from continued development in the U.S.

- SCOR Global P&C achieves strong growth with sound underlying performance, in a year marked by an exceptional series of large nat cat losses such as Hurricanes Harvey, Irma and Maria in the U.S. and the Caribbean, and wildfires in California.

- SCOR Global Life continues to deepen its franchise, particularly in Asia-Pacific, while recording satisfactory profitability.

- SCOR Global Investments delivers a return on invested assets of 3.5%. The Group is well positioned to benefit from the current rising interest rate cycle.

- The Group cost ratio is stable at 5.0% of gross written premiums, in line with the “Vision in Action” plan.

- Group net income stands at EUR 286 million in 2017, despite the cost of the nat cat events which occurred in the third and fourth quarters. The annualized return on equity (ROE) for the year reaches 4.5%, or 380 bps above the risk-free rate(1). The normalized(2) annualized return on equity stands at 10.1%, above the target of 800 bps above the 5-year risk-free rate.

- The business model delivers a high operating cash flow of EUR 1,144 million as of December 31, 2017. SCOR Global P&C provides strong cash flow in line with forecasts, having commenced but not completed payments on Q3 2017 events, while SCOR Global Life benefits from elevated technical business cash flow in Q4 2017 due to two large transactions.

- Shareholders’ equity stands at EUR 6.2 billion at December 31, 2017, after the net income contribution of EUR 286 million, the payment in May 2017 of EUR 308 million of cash dividends for the year 2016 and a EUR 521 million negative impact from currency translation adjustments, mainly due to the weakening of the U.S. dollar. This results in a book value per share of EUR 33.01 at December 31, 2017, compared to EUR 35.94 at December 31, 2016.

- SCOR’s financial leverage stands at 25.7% at December 31, 2017.

- SCOR’s solvency ratio at December 31, 2017, stands at 213%(3), in the upper part of the optimal solvency range of 185% - 220% as defined in the “Vision in Action” plan.

Confirming its active capital management policy, SCOR proposes to the Annual General Meeting a dividend of EUR 1.65 per share for 2017, unchanged from EUR 1.65 for 2016, representing a payout ratio of 108%. The ex-dividend date for 2017 will be set on April 30, 2018, and the dividend will be paid on May 3, 2018. The Group also pursues its share buy-back program, which expires mid-2019.

SCOR reaffirms all its targets and assumptions for the remainder of the “Vision in Action” strategic plan.

Full-Year and Q4 2017 key financial details

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “2017 was marked by an exceptional series of major natural catastrophes. SCOR successfully passed this real-life stress test, once again demonstrating the resilience of its business model and its shock-absorbing capacity. This confirms the relevance of our strategy based on a controlled risk appetite, an optimized risk composition, a balanced business model between Life and P&C reinsurance, and a robust capital shield through retrocession and ILS. SCOR accomplished its mission in 2017, honoring all its commitments to its clients and contributing to the protection of hundreds of thousands of people severely affected by catastrophes, while managing to deliver a good set of results. SCOR is pursuing its active shareholder remuneration policy, with a dividend of EUR 1.65 per share, to be approved by the Annual General Meeting. The Group is fully mobilized to reach the strategic targets set out in “Vision in Action”.”

1 Based on a 5-year rolling average of 5-year risk-free rates.

2 Normalized for CAT ratio (6% YTD), change in Ogden rate, IBNR reserve release, Q3 CAT impact on ILS funds and tax one-offs. No normalization is undertaken for the exceptional investment income above the expected range.

3 Solvency ratio based on Solvency II requirements. The Group solvency final results are to be filed to supervisory authorities by June 2018, and the final Solvency ratio may differ from this estimated ratio. This estimate was prepared on the basis of the business structure in existence at December 31, 2017 and tax assumptions consistent with those applied to the 2017 annual IFRS Group financial statements.

4 Normalized for CAT ratio (6% YTD), change in Ogden rate, IBNR reserve release, Q3 CAT impact on ILS funds and tax one-offs. No normalization is undertaken for the exceptional investment income above the expected range.