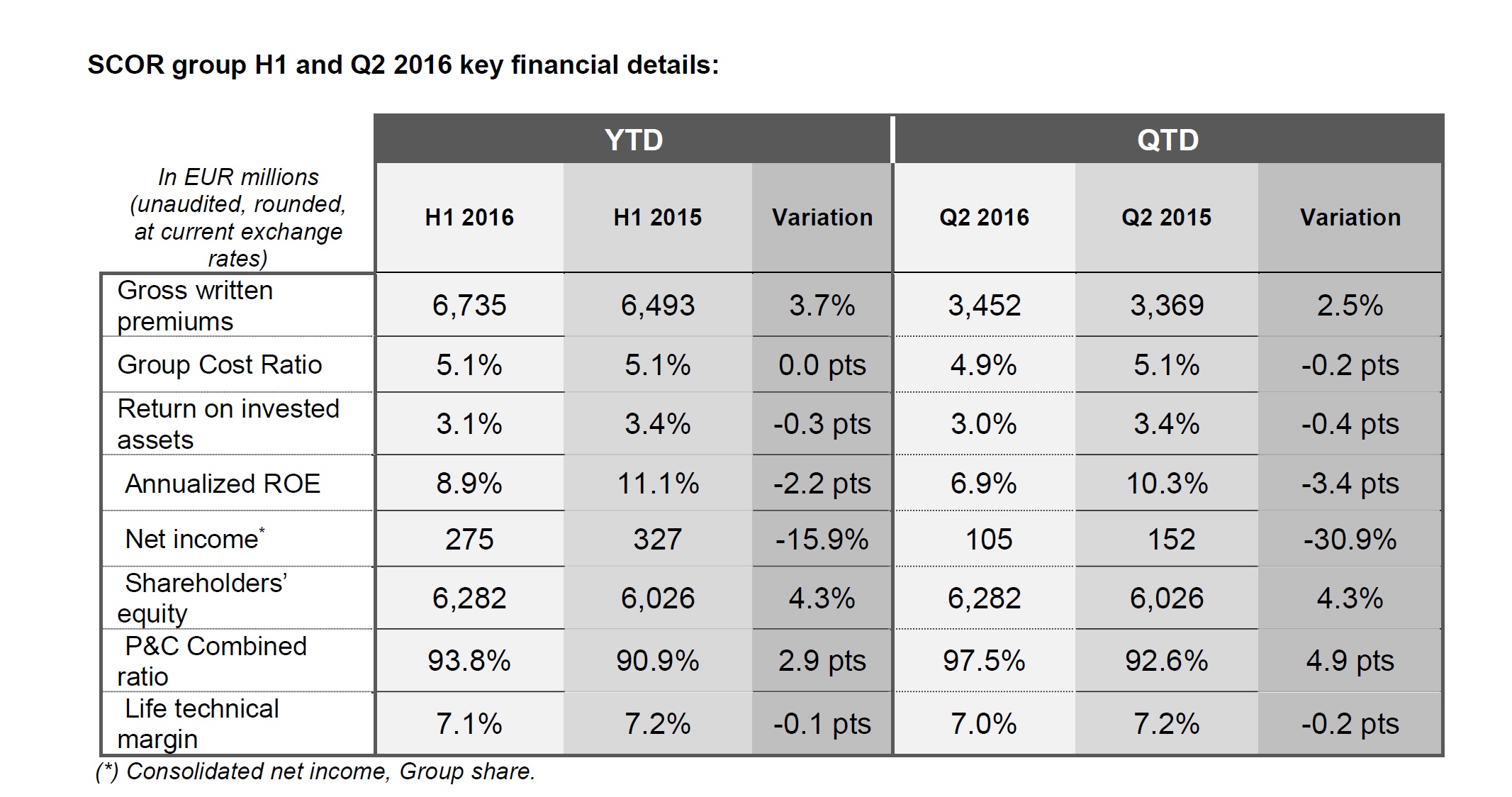

- Gross written premiums reach EUR 6,735 million at the end of the first six months of 2016, up 5.9% at constant exchange rates compared to 2015 (+3.7% at current exchange rates), with:

- a strong contribution from SCOR Global Life, with gross written premiums reaching EUR 3,934 million over the semester (+10.2% at constant exchange rates and +8.3% at current exchange rates);

- a 0.6% increase in SCOR Global P&C gross written premiums at constant exchange rates (-2.0% at current exchange rates), which stand at EUR 2,801 million in H1 2016, and excellent renewals in June and July 2016.

- SCOR Global P&C records strong technical profitability with a robust net combined ratio of 93.8% in the first half of 2016, despite a high number of events in all perils and regions in the second quarter of 2016 and with reserve releases of EUR 40 million accounting for 1.6 pts of the H1 2016 combined ratio.

- SCOR Global Life records a robust technical margin of 7.1% in the first half of 2016, continuing to deliver above the “Optimal Dynamics” assumption of 7.0%.

- SCOR Global Investments achieves a solid 3.1% return on invested assets, above the “Optimal Dynamics” assumption, in an extremely low yield and uncertain environment, while maintaining its prudent portfolio positioning to face the current headwinds and high level of market volatility.

- Group net income reaches EUR 275 million in H1 2016, down 15.9% compared to H1 2015 due to a high number of natural catastrophes and a challenging macroeconomic environment. The annualized return on equity (ROE) stands at 8.9% over the period, or 881 basis points above the risk-free rate1.

- Shareholders’ equity stands at EUR 6,282 million at 30 June 2016, compared to EUR 6,363 million at 31 December 2015 after the payment of EUR 278 million of dividends for the year 2015. This translates into a book value per share of EUR 33.79 at 30 June 2016.

- SCOR’s financial leverage stands at 31.8% as at 30 June 2016, temporarily above the range indicated in “Optimal Dynamics”, and will stand at 25.5%2 after the redemption of the two debts callable in Q3 2016. This ratio also reflects the successful placement of a dated subordinated notes issue on the Euro market in the amount of EUR 500 million with a coupon set at 3.625% in May 2016.

- SCOR’s estimated solvency ratio at 30 June 2016, adjusted for the redemption of the two debts callable in Q3 2016, stands at 210%3, within the optimal solvency range of 185%-220% as defined in the “Optimal Dynamics” plan.

1 Three-month risk-free rates.

2 Adjusted financial leverage ratio will stand at 25.5% after the redemption of the CHF 650 million and EUR 257 million subordinated debts callable in Q3 2016.

3 The H1 2016 estimated solvency ratio has been adjusted to 210% to take into account the early redemption of the two debts to be called in Q3 2016, as previously announced (the 6.154% undated deeply subordinated EUR 257 million notes callable in July 2016 and the 5.375% fixed to floating rate undated subordinated CHF 650 million notes callable in August 2016). The estimated solvency ratio based on Solvency II requirements is 230% at 30 June 2016.