Following the authorization granted by SCOR’s shareholders, SCOR signed a natural catastrophe financial coverage facility in the form of contingent capital equity line with UBS.

Under the transaction, SCOR will benefit from a contingent EUR 150 million equity line, which would be available in two separate tranches of EUR 75 million each. Drawdown on facility may result in an aggregate increase in the share capital of up to EUR 150 million (including issuance premium), in respect of which SCOR has entered into a firm subscription commitment with UBS.

The issuance of the shares will be triggered when SCOR has experienced total aggregated losses from natural catastrophes above certain thresholds (listed below under “Characteristics of the contingent equity line”) occurring over three years, between January 1, 2011 and December 31, 2013.

This innovative contingent capital solution will allow the Company to further diversify its means of protection and counterparties, offering a cost effective alternative to traditional retro and insurance-linked securities (ILS) and improving the Group’s capital shield strategy. The facility has received favorable qualitative and quantitative assessments by rating agencies.

In the absence of the occurrence of any triggering event, no shares will be issued under the facility. The facility may therefore reach its term without any dilutive impact for the shareholders.

Paolo De Martin, Chief Financial Officer of SCOR, comments: “

We firmly believe that this will form a strong complement to our traditional retro protection and ILS placements, offering us additional flexibility in pursuing our capital shield strategy at very competitive costs.”

Characteristics of the contingent equity line

The transaction will give rise to the issuance of approximately 9.5 million warrants issued by SCOR to UBS, each warrant giving UBS the right to subscribe for two new SCOR shares.

The issuance of the warrants has been authorized by the 17th resolution of the extraordinary general meeting of the shareholders of SCOR dated April 28, 2010 and approved by a resolution of its Board of Directors dated July 28, 2010.

Under the transaction agreement, SCOR has undertaken to drawdown on the facility upon the occurrence of a triggering event (resulting from natural catastrophes as described below) and UBS has undertaken to exercise accordingly the number of warrants necessary for the subscription of EUR 75 million of new shares under the relevant tranche of the facility.

The drawdowns on the facility will only be available when the amount of the estimated ultimate net loss incurred by the SCOR group as an insurer or reinsurer (as reviewed by SCOR's statutory auditors) reaches pre-defined thresholds, in a given calendar year from January 1, 2011 to December 31, 2013, as the direct result of the occurrence within that year of one or more natural catastrophe-type events. Such thresholds may be recalibrated each year by SCOR to fit the coverage levels with changes in the insurance and reinsurance market conditions within certain limits defined to ensure the consistency of the facility's risk profile over the period.

The eligible worldwide natural catastrophe events under the transaction include the following:

- earthquake, seaquake, earthquake shock, seismic and/or volcanic disturbance/eruption,

- hurricane, rainstorm, storm, tempest, tornado, cyclone, typhoon,

- tidal wave, tsunami, flood,

- hail, winter weather/freeze, ice storm, weight of snow, avalanche,

- meteor/asteroid impact,

- landslip, landslide, mudslide, bush fire, forest fire and lightning.

In addition, subject to no drawdown having been made under the facility, if the daily volume weighted average price of the SCOR shares on Euronext Paris falls below EUR 10 (i.e. a level of price close to the par value of the SCOR share), an individual tranche of EUR 75 million will be drawn down in order to ensure the availability of this financial cover (the warrants being unexercisable below par value) in case of occurrence of a natural catastrophe-type event during the remainder of the risk coverage period.

The warrants will remain exercisable until three months after the expiry of the above risk coverage period.

All subscriptions for new shares by UBS, if any, will be made at a price of 90% of the volume weighted average price of the SCOR shares on Euronext Paris over the three trading days preceding the exercise of the warrants.

UBS is committed to subscribing for the new shares but does not intend to become a long term shareholder of SCOR and will resell the shares by way of private placements and/or sales on the open market.

From the notification of the occurrence of a triggering event by SCOR to UBS until the exercise of the warrants, UBS will be prohibited from engaging in hedging transactions on the SCOR shares, other than ordinary course transactions undertaken independently by UBS's affiliated banking and brokerage businesses.

In current market conditions (i.e. issuance price of EUR 15.4972 based on 10% discount on a 3 day volume weighted average price of EUR 17.2191( ) per share), the transaction accounts for a maximum of 5.16%. of SCOR's share capital( ) and for a maximum of 8.88% with a 3 day volume weighted average price of EUR 10 per share (i.e. issuance price of EUR 9 per share after 10% discount). Accordingly, no prospectus will be prepared in connection with the setting-up of this contingent equity line. SCOR will make the appropriate disclosures to the market in compliance with applicable market regulations at the time of (i) the issuance of the warrants (expected to take place at the end of December 2010) and of (ii) the issuance of the new shares regarding the circumstances of such issuance, the issuance price and the number of shares issued and the consequences of such issuance for its shareholders.

The transaction will have no impact on SCOR 2010 accounts except for the non-significant subscription amount received by SCOR from UBS for the warrant issuance (EUR 0.001 per warrant).

Limited potential dilutive impact of the transaction for SCOR Shareholders

This innovative financial coverage is an event-driven contingent capital equity line, which may be triggered upon the occurrence of the above-described triggering events only. Its potential dilutive impact therefore depends on the probability of occurrence of such triggering event.

SCOR management believes that there is a significant net economic benefit of such contingent capital solution for its shareholders, as it favourably compares with traditional retrocession or ILS and optimises SCOR’s risk protection costs with limited potential dilutive impact. SCOR estimates that the probability of both triggers occurring simultaneously in a year is only 6%.

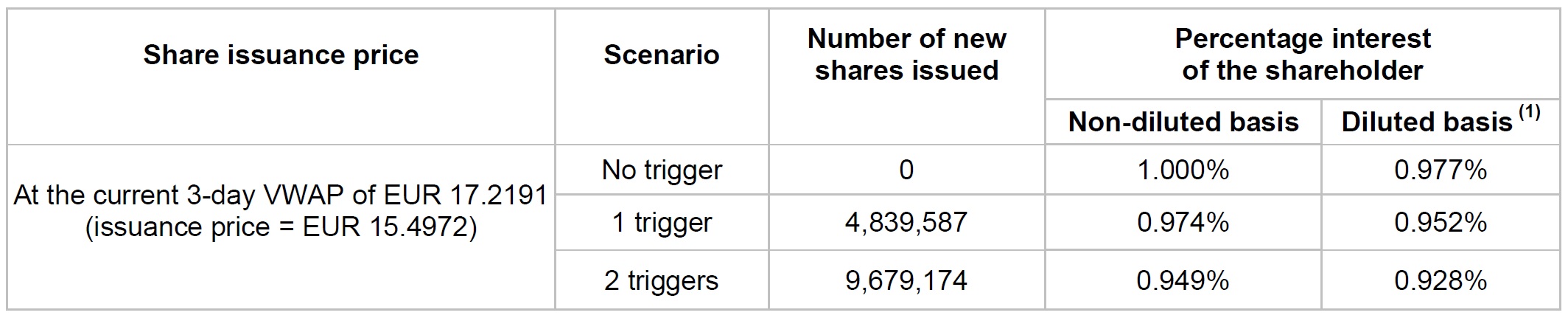

The following chart summarizes the potential dilutive impact of the transaction under various scenarios for a shareholder holding 1% of SCOR's share capital prior to the share issuance (calculated on the basis of the number of shares that make up the share capital as of June 30, 2010).