Body

- SCOR delivers a strong start to 2019 by combining profitable growth, good technical profitability and strong solvency.

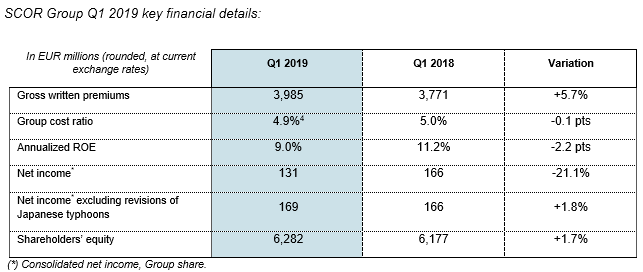

- Gross written premiums stand at EUR 3,985 million, up 5.7% at current exchange rates (up 2.0% at constant exchange rates). In P&C, gross written premiums are up 16.1% at current exchange rates (up 12.8% at constant exchanges rates). This reflects the very positive January renewals1 and is driven by the growth of the portfolio, particularly in the U.S., in the second half of 2018. In Life, gross written premiums are down 1.1% at current exchange rates (down 5.0% at constant exchange rates); the variation is largely driven by the renewal of certain Financial Solutions deals recorded as fee business rather than as premiums in Q1 2019. Excluding these deals, gross written premiums would have grown by 2.5% at constant exchange rates.

- SCOR Global P&C delivers excellent profitable growth in Q1 2019. The net combined ratio of 94.6% is better than the “Vision in Action” assumption, despite the impact of the significant upward market revisions during Q1 2019 of the estimated cost of Typhoons Jebi and Trami, which took place in Q3 2018 (+ EUR 53 million before tax / + EUR 38 million after tax).

- SCOR Global Life delivers strong profitability alongside franchise development in Asia-Pacific and records an excellent technical margin of 7.2%.

- SCOR Global Investments delivers a strong return on invested assets of 2.8%, supported by an income yield of 2.7%.

- Group net income is EUR 131 million for the quarter. The return on equity (ROE) is 9.0%, or 828 bps above the risk-free rate2.

- Net operating cash flows stand at EUR 117 million, with positive contributions from both divisions. SCOR Global P&C’s cash flow has been impacted by payments on 2018 cat events and SCOR Global Life provides strong cash flow, despite the seasonality of client settlements.

- Shareholders’ equity is EUR 6.3 billion at March 31, 2019. This results in a strong book value per share of EUR 33.64, compared to EUR 31.53 at December 31, 2018.

- Financial leverage stands at 25.9% on March 31, 2019, down 1.6 pts compared to December 31, 2018.

- Estimated solvency ratio is 219% at the end of the quarter, at the upper end of the optimal solvency range of 185% - 220% as defined in the “Vision in Action” plan, up 4 pts compared to December 31, 2018.

- The Group completed the merger of its 3 SEs during the quarter3, optimizing its capital under Solvency II, leading to approximately EUR 200 million of solvency capital benefits.

- SCOR is proposing a 2018 dividend per share of EUR 1.75 at today’s Annual General Meeting, up 6% compared to last year, to be paid on May 2, subject to shareholders’ approval.

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “The strong start to 2019 bears witness to the depth of SCOR’s franchise and the relevance of the Group’s strategy. The Group’s technical profitability is highly satisfactory, as demonstrated respectively by the P&C combined ratio and the Life technical margin. Both the solvency ratio and the ROE are in line with the targets of the plan. SCOR continues to create long-term value and provides its shareholders with attractive returns, raising the dividend per share to EUR 1.75 subject to approval by today’s Annual General Meeting.”

1 See press release dated February 7, 2019

2 Based on a 5-year rolling average of 5-year risk-free rates.

3 See press release dated April 1, 2019.

4 Q1 2019 Group cost ratio of 4.7% if calculated on a same basis as Q1 2018.