Body

- SCOR delivers a strong start to 2018 by combining profitable franchise expansion, robust earnings and a strong solvency position.

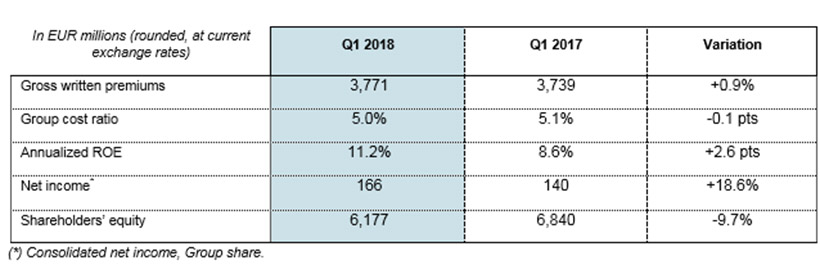

- Gross written premiums reach EUR 3,771 million, up 10.2% at constant exchange rates (up 0.9% at current exchange rates), resulting from growth in both Life (up 14.7% at constant exchange rates), and P&C (up 3.9% at constant exchange rates).

- Strong technical results, with a superior 91.8% P&C net combined ratio, a 6.8% Life technical margin impacted by portfolio mix and foreign exchange rates, and a return on invested assets of 2.3%.

- Group net income reaches EUR 166 million in Q1 2018, an increase of 18.6% compared to net income of EUR 140 million in Q1 2017. The annualized return on equity (ROE) stands at 11.2% or 1,049 bps above the risk-free rate1.

- Strong estimated solvency ratio of 222% at March 31, 2018, marginally above the optimal range of 185% - 220% defined in the “Vision in Action”2 plan following robust capital generation and a favorable interest rate environment.

- Net operating cash flows stand at EUR 123 million in the first quarter of 2018, which should normalize to EUR 200 million per quarter, mainly impacted by payments from Q3 2017 cat events, while Life benefits from strong technical cash flow. Cash flow from financing activities principally reflects the successful issuance of a USD 625 million subordinated Tier 1 (“RT1”) debt3.

- SCOR’s financial leverage stands at 30.1% at March 31, 2018, temporarily above the range indicated in “Vision in Action”. The adjusted financial leverage ratio would be 26.2% when allowing for the intended calls of the two debts callable in June and November 2018.

- Shareholders’ equity stands at EUR 6,177 million at March 31, 2018, compared to EUR 6,225 million at December 31, 2017. This translates into a book value per share of EUR 32.49 at March 31, 2018, compared to EUR 33.01 at December 31, 2017.

- SCOR will propose an attractive 2017 dividend per share of EUR 1.654 at the Annual General Meeting.

- The recent U.S. tax reform has required SCOR to implement certain changes to its operational structure. No accounting charge stemming from the U.S. tax reform is being accounted for in Q1 2018. The total non-recurring tax expense for the target operational structure is expected to be in the lower half of the USD 0 - 350 million range that was communicated in SCOR’s full-year 2017 disclosure . The Group expects a limited impact on the solvency ratio. SCOR anticipates booking an accounting charge in Q2 2018 and the Group expects the implementation to be substantially completed by H2 2018.

SCOR Group Q1 2018 key financial details:

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “SCOR is off to a strong start for 2018: successful P&C renewals, the continued expansion of the Life business in key markets, notably Asia-Pacific, and a well-received debt issuance. The Group holds firmly to its “Vision in Action” plan and is on track to deliver on its targets. The Group continues to pursue its attractive shareholder remuneration policy, with a dividend of EUR 1.65 per share that has been submitted for approval at the Annual General Meeting. SCOR is strategically positioned for growth across its businesses and in targeted geographies.”

(1) Based on a 5-year rolling average of 5-year risk-free rates over the cycle.

(2) See page Appendix for “Vision in Action” targets.

(3) See Press Release distributed on March 6, 2018.

(4) 2017 Dividend subject to approval of the Shareholders’ Annual General Meeting on April 26.