SCOR delivers a solid performance in the first nine months of 2019 and achieves both targets of the new strategic plan “Quantum Leap”, profitability and solvency, in spite of a third quarter marked by a series of natural catastrophes and man-made losses.

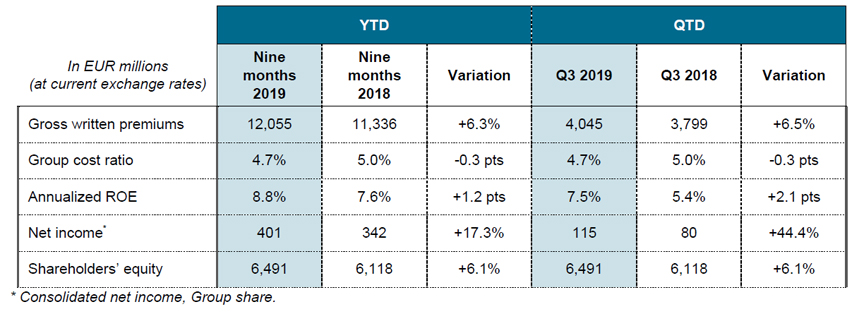

- Group net income stands at EUR 401 million in the first nine months of 2019, up 17.3% compared to the first nine months of 2018. The return on equity (ROE) is 8.8%, 816 bps above the risk-free rate[1], exceeding the profitability target of the new plan “Quantum Leap”.

- Gross written premiums total EUR 12,055 million in the first nine months of 2019, up 3.2% at constant exchange rates (up 6.3% at current exchange rates). In P&C, gross written premiums are up 11.5% at constant exchange rates (up 14.6% at current exchange rates). In Life, gross written premiums are down 2.5% at constant exchange rates (up 0.7% at current exchange rates). This variation is largely driven by the renewal of certain Financial Solutions transactions as fee business (rather than as premiums) since the beginning of the year. Excluding these transactions, Life gross written premiums would have grown by 3.8% at constant exchange rates.

- SCOR Global P&C delivers strong growth and solid technical results, with a combined ratio of 95.7% for the first nine months of 2019 in spite of heavy loss activity in Q3 2019.

- SCOR Global Life continues to expand its franchise in Asia and delivers a strong level of technical profitability in the first nine months of 2019 and records a solid technical margin of 7.2%.

- SCOR Global Investments delivers a solid return on invested assets of 3.0% in the first nine months of 2019, supported by an income yield of 2.6% and benefiting from realized gains of EUR 43 million in Q3 2019 QTD largely from real estate sales.

- Group cost ratio (expressed as a percentage of the Group’s gross written premiums) stands at 4.7%[2], running below the “Quantum Leap” assumption of ~5.0%.

- Group total cash flows stand at EUR 693 million in the first nine months of 2019 and net operating cash flows stand at EUR 573 million, with strong cash flows from SCOR Global P&C despite significant payments on 2017 and 2018 cat events. SCOR Global Life experienced lower cash flow as a result of the volatility on claims payment activity and seasonality of tax settlements. The Group’s total liquidity is very strong at EUR 2.1 billion at September 30, 2019.

- Shareholders’ equity stands at EUR 6.5 billion at September 30, 2019, up by EUR 0.7 billion in the first nine months of 2019, after the dividend payment of EUR 325 million in May 2019. This results in a strong book value per share of EUR 34.71, compared to EUR 31.53 at December 31, 2018.

- Financial leverage stands at 25.1% on September 30, 2019, improving by 2.4% points compared to December 31, 2018.

- Estimated solvency ratio stands at 203% on September 30, 2019, in the optimal solvency range of 185% - 220% as defined in the “Quantum Leap” strategic plan. The capital generation is positive. The reduction in solvency is notably driven by the decrease in interest rates since the beginning of the year.

- SCOR’s rating level of AA- was reaffirmed by AM Best and S&P[3] during the third quarter of 2019.

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “SCOR records a solid performance in the first nine months of 2019, achieving its solvency target and outperforming its profitability target of its new strategic plan “Quantum Leap”. SCOR demonstrates once again its capacity to successfully combine profitability and solvency, in spite of challenging conditions that the industry faced in the third quarter of 2019, marked by a series of natural catastrophes and man-made P&C claims, combined with historically low levels of interest rates. The Group continues to expand and deepen its franchise both on U.S. P&C, the largest market in the world, and on Life reinsurance in Asia-Pacific. The award granted to SCOR as “North American Reinsurer of the Year” is a testimony of both the quality and the development of the Group’s franchise in North America. The Group is fully mobilized to pursue value creation for the benefit of all stakeholders.”

SCOR Group nine months and Q3 2019 key financial details:

[1] Based on a 5-year rolling average of 5-year risk-free rates (67 bps in Q3 2019 YTD)

[2] As of Q3 2019, the cost ratio takes into account IFRS 16 accounting rules. Excluding the renewal of certain Financial Solutions deals as fee business, and under IFRS 16, the cost ratio would stand at 4.6%

[3] Please refer to press releases issued on September 9, 2019 for S&P and September 30, 2019 for AM Best