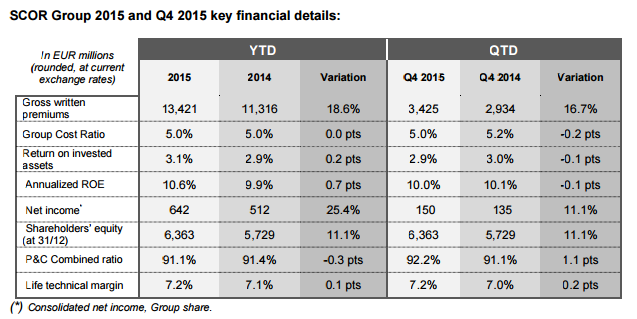

- Gross written premiums reach EUR 13,421 million, up 18.6% at current exchange rates compared to 2014 (+6.4% at constant exchange rates). This significant growth is driven by the contribution of the two business divisions:

- SCOR Global P&C gross written premiums increase by 16.0% at current exchange rates (+4.9% at constant exchange rates) to EUR 5,723 million;

- SCOR Global Life gross written premiums reach EUR 7,698 million, up by 20.6% at current exchange rates (+7.5% at constant exchange rates).

- SCOR Global P&C records very strong technical profitability with a net combined ratio of 91.1% in 2015, in an environment of low natural catastrophe losses but with an unusually high frequency of large man-made losses.

- SCOR Global Life records a strong technical margin of 7.2% in 2015, consistently delivering above the “Optimal Dynamics” assumption of 7.0%.

- SCOR Global Investments achieves a solid 3.1% return on invested assets, while maintaining its prudent portfolio management.

- The Group cost ratio remains stable in 2015 at 5.0% of premiums.

- Group net income reaches EUR 642 million in 2015, an increase of 25.4% compared to 2014. The annualized return on equity (ROE) stands at 10.6% or 1,055 bps above the risk-free rate1.

- Shareholders’ equity increases by 11.1% in 2015 to reach EUR 6,363 million at 31 December 2015, compared to EUR 5,729 million at 31 December 2014, after the payment of EUR 260 million of dividends in May 2015. This translates into a book value per share of EUR 34.03 at 31 December 2015, compared to EUR 30.60 at 31 December 2014. This increase is driven by the high net income contribution and a favourable currency translation adjustment of EUR 316 million.

- SCOR’s solvency ratio, adjusted for the intended calls of the two debts callable in Q3 2016, stands at 211%2, within the optimal solvency range of 185%-220% as defined in the “Optimal Dynamics” plan. This ratio stood at 202% at 31 December 2014.

- SCOR’s financial leverage stands at 27.5% as at 31 December 2015, temporarily above the range indicated in “Optimal Dynamics”. This is the result of the successful placement of EUR 250 million dated subordinated debt, issued with a coupon set at 3.25% in June 2015, and the placement of the dated subordinated debt of EUR 600 million3 to refinance the undated subordinated debt of CHF 650 million callable in August 2016. In addition, SCOR called two debts in 2015, due in 2029 and 2020, for EUR 10 million and EUR 93 million both at par-value. The financial leverage adjusted for the intended calls of the two debts callable in Q3 2016, would stand at 20.6%4 within the optimal range indicated in “Optimal Dynamics”.

- During 2015, the Group’s strategy and financial strength continued to be recognized by the rating agencies, with the upgrades to AA- by Fitch and S&P respectively in July and September, and the outlook raised to positive on the respective ratings of A.M. Best (A positive outlook in September 2015) and Moody’s (A1 positive outlook in December 2015).

- SCOR will propose to the Annual General Meeting an increased dividend of EUR 1.50 per share for 2015, up from EUR 1.40 for 2014, representing a payout ratio of 43%. The proposed ex-dividend for 2015 will be set at EUR 1.50 on 28 April 2016 and the dividend will be paid on 2 May 2016.

Denis Kessler, Chairman & CEO of SCOR, comments: “The 2015 SCOR results may be qualified as excellent. The Group continued to develop in line with its strategic plan “Optimal Dynamics”. It recorded solid technical and financial profitability and achieved an optimal level of solvency, as demonstrated by its internal model, which was approved by the supervisory authorities. SCOR thus reconfirms its status as a Tier One Reinsurer, as evidenced by the upgrade of its financial rating. The Group is pursuing innovative initiatives, developing new tools to improve its underwriting and management. SCOR is well positioned to meet the challenges posed by the economic, financial, industrial and social changes that will mark 2016.”

1 Three-month risk-free rate.

2 The 211% adjusted solvency ratio allows for the intended calls of the two debts callable in Q3 2016 (the 6.154% undated deeply subordinated EUR 257 million notes callable in July 2016 and the 5.375% fixed to floating rate undated subordinated CHF 650 million notes callable in August 2016), subject to the evolution of market conditions and supervisory approval. The solvency ratio based on Solvency II requirements is 231% at year-end 2015.

3 See press releases of 2 June 2015 and 2 December 2015 respectively.

4 Adjusted financial leverage ratio would be approximately 20.6% assuming the repayment of the CHF 650 million and EUR 257 million subordinated debts callable in Q3 2016, subject to the evolution of market conditions and supervisory approval.