Body

SCOR delivers good financial results as well as strong core earnings from both Life and P&C for the first nine months of 2014, in line with its strategic plan assumptions. Based on its powerful cornerstones, the Group leverages its value proposition as a Tier 1 global reinsurer.

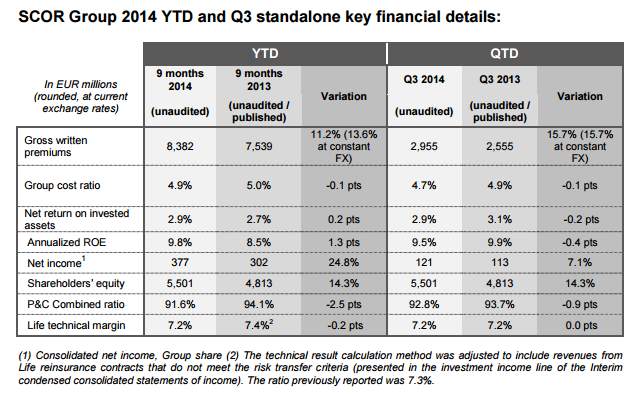

- Gross written premiums stand at EUR 8,382 million, up 13.6% at constant exchange rates (+11.2% at current exchange rates) in the first nine months, driven by the growth of SCOR Global Life’s financial solutions in Asian and Latin American countries, by the Generali US contribution and by SCOR Global P&C’s increased top line, despite unfavourable exchange rates:

- SCOR Global P&C records gross written premium growth of 3.4% at constant exchange rates to EUR 3,679 million (+0.9% at current exchange rates), in line with the assumption of EUR 5 billion in annual gross written premiums stated at the January 2014 renewals;

- SCOR Global Life gross written premium increase of +5.6% on a pro-forma basis at constant exchange rates (+23.1% at constant exchange rates, on a published basis) to EUR 4,703 million, notably supported by a strong focus on financial solutions in Asian and Latin American countries and a positive impact from the Generali US acquisition.

- SCOR Global P&C’s net combined ratio stands at 91.6% for the first nine months of 2014, compared to 94.1% for the first nine months of 2013. This ratio reflects very strong technical results, driven by the year-on-year improvement of the attritional ratio and the low level of natural catastrophes in the first nine months of 2014.

- SCOR Global Life’s technical margin reaches 7.2% in the first nine months of 2014, compared to 7.4%1 on a pro-forma basis in the first nine months of 2013.

- SCOR Global Investments achieves a 2.9% return on invested assets over the period thanks to its active portfolio management, and continues the rebalancing of its investment portfolio in line with “Optimal Dynamics” orientations.

- For Q3 standalone, SCOR records strong operating cash flow, up 16.1% to EUR 468 million.

- SCOR’s net income reaches EUR 377 million for the first nine months of 2014, up 24.8% compared to the first nine months of 2013, thanks to strong technical results from both Life and P&C. On an annualised basis, the return on equity (ROE) reaches 9.8% for the first nine months of 2014.

- SCOR books a record shareholders’ equity position of EUR 5.5 billion, with book value per share at EUR 29.36 at 30 September 2014 (versus EUR 26.64 at 31 December 2013), after distribution of EUR 243 million in cash dividends.

- SCOR’s financial leverage stands at 20.0% at 30 September 2014, decreasing by 1.2 pts compared to 31 December 2013 and below the 25% ceiling defined in “Optimal Dynamics”. The Group successfully issued EUR 250 million and CHF 125 million perpetual subordinated debt, which will be settled and accounted for in Q4 2014.

- The Group continues its cost control policy and optimizes its resources with a cost ratio of 4.9% for the first nine months, in line with “Optimal Dynamics” assumptions.

The Group’s annual Investors’ Day held in September confirmed that SCOR is firmly on track with the implementation of its “Optimal Dynamics” plan, which has been in place for just over a year. Despite the numerous headwinds faced by the industry, SCOR’s business model has demonstrated its robustness and enabled the Group to confirm its strategic targets focused on profitability and solvency, as well as its consistent dividend policy.

SCOR’s risk profile, strong solvency and high profitability have once again been recognised by Fitch, which raised the outlook on SCOR’s “A+” rating to positive on 20 August. A.M. Best and S&P have recently confirmed their ratings for SCOR, S&P having upgraded the Group’s “capital and earnings” score from “strong” to “very strong” and its “liquidity” score from “strong” to “exceptional”.

In line with its strategic target to optimize the financial structure of the Group, SCOR has successfully placed two perpetual subordinated debt issues of EUR 250 million and CHF 125 million2, with coupons set at 3.875% and 3.375% respectively, thereby demonstrating SCOR’s strong capital market access and financial flexibility.

According to its strategic assumptions, SCOR is expanding its business in emerging markets by developing a local presence and appropriate added-value solutions for its clients. In this regard SCOR launched a local entity in Brazil in September, with SCOR Brasil Re offering Life and P&C solutions to its Brazilian clients.

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “As stated at the Investors’ Day in September, SCOR’s business model fits with today’s competitive environment, enabling the Group to deliver a strong financial performance. SCOR’s leading position as a Tier 1 reinsurer has been recognised by both the industry and the rating agencies, which have acknowledged the pertinence of our strategy and the robustness of our financial profile. SCOR is now actively preparing its renewal campaign in January, whilst fully respecting its technical profitability target.”

1 The technical result calculation method was adjusted to include revenues from Life reinsurance contracts that do not meet the risk transfer criteria (presented in the investment income line of the Interim condensed consolidated statements of income). The ratio previously reported was 7.3%.

2 See press releases of 25 September 2014 and 24 September 2014 respectively.