Sustainability at the core of investment

SCOR is pleased to announce the release of its 2019 Sustainable Investment Report.

May 14, 2020

Editorial by François de Varenne, Chief Executive Officer of SCOR Global Investments

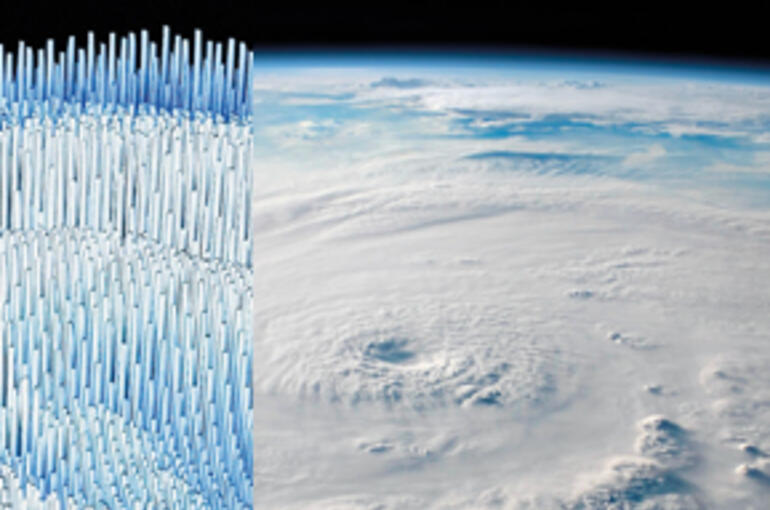

“The world is facing incredible sustainability challenges and climate change may have a disruptive impact on our lives and economies. Contributing to the welfare and resilience of Society is one of SCOR’s missions and as an institutional investor, the Group is determined to play its part.

2019 has been a key milestone for SCOR. With its new strategic plan «Quantum Leap», SCOR has accelerated its sustainability journey, strengthening its commitment to investing in a more sustainable world. In 2019, SCOR published its Sustainable Investing Policy. Supporting and complementing the Group’s Climate Policy, this policy is a public commitment to further onboard Environmental, Social and Governance issues in our investment strategy. Adhering to the UN-supported PRI enables us to leverage industry capabilities to engage, strengthen responsible investment culture and foster greater transparency and efficient actions.

As a reinsurer, we believe that our internal expertise on climate risk can be leveraged to better manage our assets and create superior long-term value. It’s time to take additional action and commit to further considering the impacts of our invested assets on our ecosystems. Focusing on climate change, major steps were taken in 2019 by further divesting from coal, by expanding this policy to arctic oil and tar sands, and by committing to carbon neutral investment by 2050. These are strong signals that SCOR intends to deliver and align with the Paris agreement. Because risk management is in our DNA, we also continuously improve the way we tackle the impacts of climate change on our invested asset portfolios, particularly in terms of stress testing their resilience. Having produced a heatmap last year to assess our exposure to transition risks, we deepened our analysis in 2019 with the help of some innovative public initiatives in this regard.

Focusing a significant amount of our invested assets on financing the transition to a low carbon economy is also part of our strategy for building a resilient portfolio and fostering adaptation to a changing world. Sharing know-how to enhance our understanding and benefit from mutual expertise is another aspect of our sustainable investing strategy. We continue to actively participate in the public debate on shaping the future of sustainable finance.

SCOR is honored to be a member of the Technical Expert Group on Sustainable Finance at the European Commission, and a member of the Climate and Sustainable Finance Commission at the French Autorité des Marchés Financiers. This further demonstrates our commitment to playing our part in the creation of a more sustainable world.”