The latest issue of SCORViews, the newsletter of SCOR Global Life in the Americas, features articles written by senior managers and analysts who examine emerging trends and important tactical issues in the life insurance industry. This October 2017 publication focuses on better understanding the correlation between mortality, lapse and consumer behavior

Life insurers have accumulated abundant lapse data, and mortality experience is emerging for policies in the early end of level premium durations. Where companies have less experience, however, is in clearly understanding the correlation between mortality, lapse and consumer behavior. The industry is working hard to increase its understanding of these interactions as more experience data emerges. This is a focus area for SCOR’s R&D team.

When the end of the product horizon is reached, a policyholder generally has four options:

- Lapse the product (stop payment and coverage)

- Replace with a new product, typically requiring at least some new underwriting

- Convert to a permanent product, generally with higher premiums

- Keep coverage while paying a new schedule of premiums.

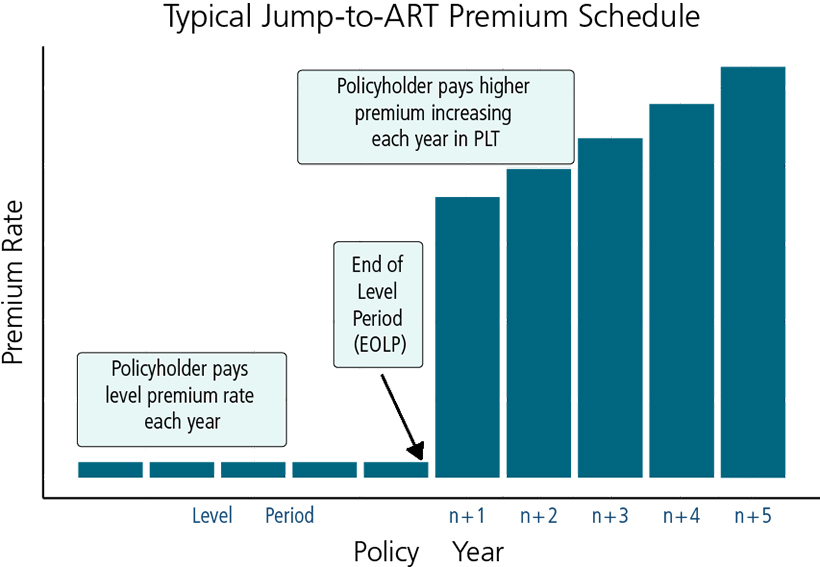

Some variations of the last option exist, but this article is focused on the historically most popular version, which is known informally as Jump to ART. Typically this implies a large spike in the first premium followed by annual premium increases of about 10%. Future publications will discuss alternative versions which are becoming more prevalent.

This post level term (PLT) structure was added to US term products in the 1990s and early 2000s. Over the past number of years, experience has emerged and as a result analysis has been kicked off to observe the policyholder behavior in reaction to reaching the end of level period (EOLP).

Determining the appropriate post-level (referring to after the fixed period) premium to charge is not an easy task. Not only is the policyholder much older, but so much time has elapsed since the policy was last underwritten, especially for longer level premium

periods, the risk classification is no longer very reliable.

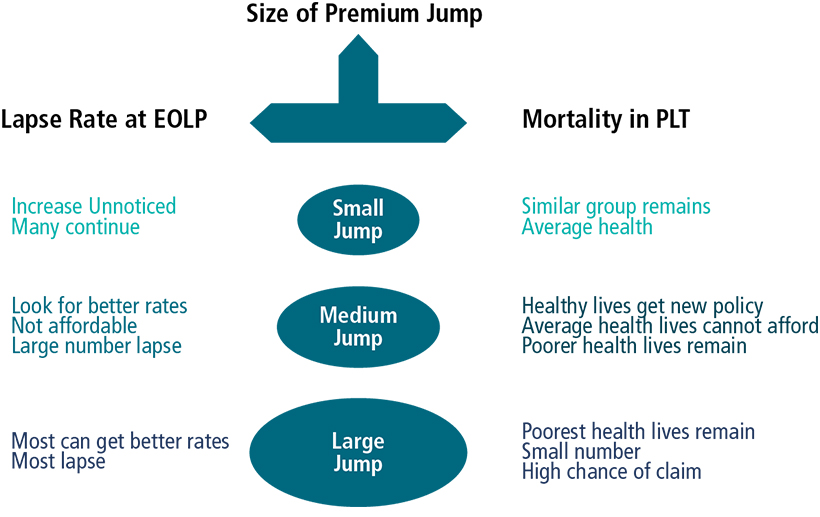

Often, companies increase the premiums by 10-20 times (or more) to deter most policyholders from continuing to stay on the books. The remaining policyholders are the least healthy and experience much higher mortality rates, behavior known as anti-selection.

Conversely, some products were priced with lower premium increases that would not only retain the anti-selectors but some healthier lives that would help offset the adverse mortality experience. Enough experience has now emerged which provides a spectrum of outcomes that help us model the relationship between premium increase, persistency, and mortality.

SCOR’s Research & Development

Given that SCOR reinsurers a large block of US term business and since term is a key product line for our clients, policyholder behavior at the end of level term is a prime topic for our Mortality R&D team. In late 2016, the team launched a major project to assess our PLT lapse and mortality experience on 10- and 15-year term products. Experience for longer duration level premium periods was not studied as data was limited.

The study includes premium information with more than 200,000 lapses and 1,000 post-level claims, sufficient for a credible study. We performed thorough statistical analysis on this data and have built models for post-level behavior.

Shock Lapse

The initial lapse that occurs immediately before the first premium increase is referred to as the shock lapse and typically is the largest lapse rate. For higher premium increases, these rates can approach 100% and often are modeled at 100% beyond a certain

threshold.

Our research has shown that a Generalized Linear Model (GLM) produces a strong fit. Usually a logistic or negative binomial (i.e., over-dispersed Poisson) regression is deployed. Both models have attractive features: logistic regression ensures the

outcome is constrained between 0 and 1 while negative binomial regression models counts and can account for high variance.

Premium increase is highly correlated with shock lapse and research shows no other variable provides as much explanatory power as premium jump. However, including additional extraneous and confounding variables are vital to producing a reliable model.

Difficulties can arise from the association among the explanatory variables which should be accounted for. For example, age and premium jump have a compound effect which can be modeled by including an interaction term. Some factors are assumed to have a

direct effect (such as age) while others are confounding variables and may be used as a proxy – for example, face amount can be used as a socio-economic proxy and as a proxy for the nominal premium increase.

Even when accounting for common variables – such as age, sex, class, etc. – SCOR finds material differences in lapse behavior among companies. Some of these factors may be difficult to quantify and can be attributed to unseen drivers such as marketing

strategy, geographic location and reputation.

Post-shock Lapse

Post-shock lapses can be modeled using a combination of the same factors used in the shock lapse model and an auto-regressive component. Again, careful treatment of the interaction among the explanatory variables needs to be considered. Using prior lapses

as the input to the autoregressive component have produced successful models. In fact using the shock lapse and post-level duration as the only autoregressive inputs generate accurate predictions.

We strive to find a parsimonious model and perform several tests including cross-validation, factor analysis, ROC curve analysis, etc. Still, professional judgment is used. For example if a slightly more accurate model is a lot more cumbersome to implement and maintain, the business needs are considered as well.

Post-level Mortality

Since we are only considering the “Jump to ART” product structure, most of the premiums follow a similar pattern: a large one-time premium spike followed by annual increases around 10%. While more data is still needed to provide a complete picture of postlevel mortality behavior, called mortality deterioration, a definite pattern has emerged in the data.

Post-level mortality is typically modeled as the ratio of the expected mortality to the base mortality (expected mortality if no premium increases occurred). The Dukes-MacDonald algorithm and its variations have been successful in producing a table of estimates for these ratios.

Producing a discrete table to model PLT mortality behavior has been successful except for what may be the most crucial area: the high premium jump / high shock lapse cohort. A Catch-22 often leaves us guessing what the mortality pattern extrapolates to for the high shock lapsers: we need a lot of exposure to produce credible experience but it takes a long time for sufficient exposure to emerge due to especially low persistency. Hence a flexible continuous function can help us understand how mortality might extrapolate and can be extremely useful when experience at the fringe is sparse.

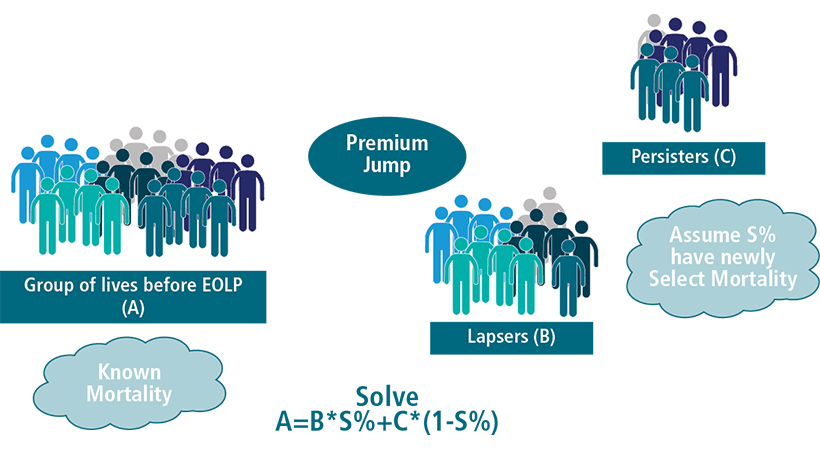

A summary of the basic Dukes-MacDonald algorithm is as follows:

- Assume a base lapse rate.

- Calculate the shock lapse rate.

- Assume the excess lapsers are a mixture of healthy lives and anti-selectors.

- Assume the persisters are a mixture of healthy lives and anti-selectors.

- Assume the sum of the excess lapsers and persisters equals the expected base mortality.

- Back into the persister mortality based on the above information.

A non-linear pattern in the PLT mortality behavior became apparent after using experience to produce a table varying by post-level duration and shock lapse bin. Using a variant of gradient descent (with momentum), we calibrated a function that fit the table and the data using only shock lapse rate and post-level duration as the input variables. This allows us to produce a continuous spectrum of outcomes and model the high shock lapsers more accurately.

Going Forward

As more experience emerges and data become richer, we have more models at our disposal, including machine algorithms which usually require a large depth of data to be successful.

PLT experience from products with longer level periods, such as 20- and 30-year periods, are beginning to emerge. SCOR is committed to extending the R&D work to deepen our understanding of policyholder behavior around this important product feature. Associations we have yet to include in our modeling but have reason to believe exist will become practical as we collect more data.

In addition, other post-level premium structures have become prevalent in the market and our research is expanding to study differences in lapse and mortality as premium structures vary. Different structures will likely have different models to begin with, but with enough data we may have the ability to create a model that generalizes many of the premium structures into one model.

Authors:

Aisling Bradfield - Actuary, Policyholder Behaviour - Research & Development

Tim Roy - Actuary, Mortality - Research & Development