Insurtech innovation is disrupting the life insurance industry, and observers agree that we are still in the early stages of transformational change. Driven by the tremendous growth of electronic data, analytics, medical science and mobile interfaces, life insurers are beginning to rethink their traditional roles and business models. They are exploring new ideas and formulating new strategies for future growth.

SCOR is engaged in multiple efforts to support clients as they adapt to the evolving landscape. In addition to our continuing commitment to underwriting R&D and risk analytics, SCOR is investing in Insurtech and partnering with companies in the health and wellness arena. This gives us the insight needed to evaluate and share with clients our perspective on new players and capabilities available to them. It also lets us work in collaboration with clients and outside partners to build and pilot new customer propositions.

Building partnerships for future financial success

Partnerships – both inside and outside the industry – are a critical element of new business models taking shape across the industry. Life insurers at the frontier are joining forces with other companies to share data, technology, analytics, and customers and to expand their offering beyond traditional risk protection. Alliances are being formed to modernize the entire value chain from product development and marketing to customer service and claims adjudication.

And there is no shortage of parties that want to team up with life insurers. Start-ups and established entities see growth opportunities in a large market that for a variety of reasons has been slow to change.

For example, Plug and Play, the global technology accelerator and venture fund, introduced an insurance innovation platform three years ago to bring together complementary partners. Start-ups targeting this space gain guidance and insights from experienced industry players, while established insurers get access to innovative technology solutions. That Plug and Play Insurance quickly became one of their best-attended programs reflects the need for innovation in the insurance space.

The recent Expo held in San Diego featured entrepreneurs with solutions for automated underwriting, digital platforms for millennials, customer/user experience, etc. The desire among life insurers to become digital organizations offering new and innovative products is the driving force behind Plug and Play Insurtech.

SCOR became an anchor partner of Plug and Play in 2017. We have engaged with start-ups all along the customer journey, from the frontend with new disrupting distributors of life insurance to the backend with health and wellness platform providers, and many in between.

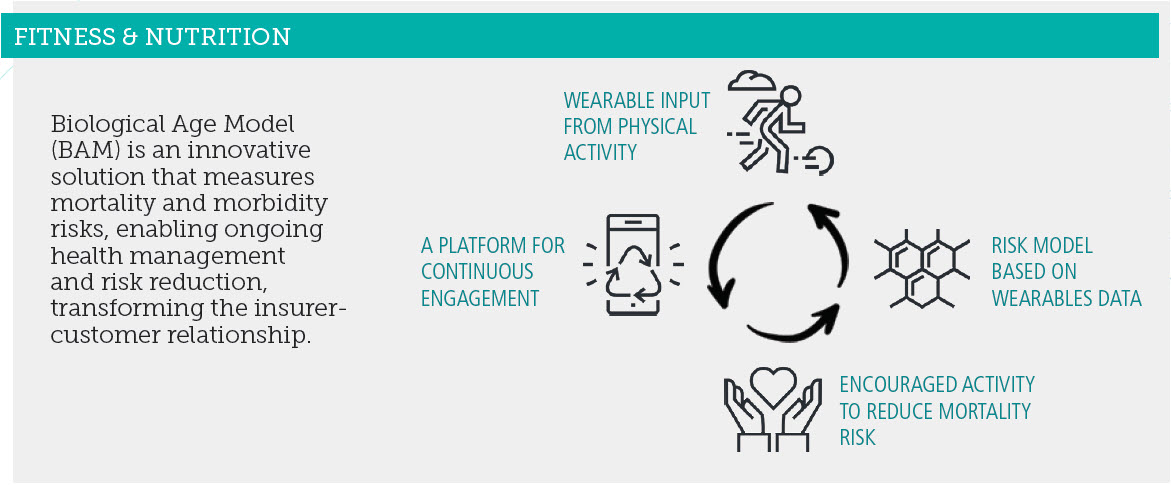

Customers today are more digitally-enabled, more health conscious and more demanding of customized products and services that offer greater freedom and flexibility. BAM is one example of the global movement in health and wellness. Though it is not currently available in the United States, BAM is in use in Asia and is being introduced in Europe. Learn more on SCOR.com.

A health & well-being movement

One of the most promising developments in innovation involves coupling life insurance with health and wellbeing programs. We are in the very early stages of life insurers forming partnerships and executing pilots to offer new and existing customers programs for fitness and nutrition, health assessment, disease management and life-saving services that, for example, can detect cardiac arrest. The level of support ranges from connected health and fitness apps and on-line coaches to DNA sequencing and oncology care plans.

This movement will create a new vision for life insurance – one that encourages people to adopt a healthier lifestyle, that reduces or postpones the onset of certain conditions and, ultimately, that may result in longer lives for their customers.

Many of these offerings include wearables and other sensor-based technology. In exchange for rewards (gift cards, gym discounts, premium discounts), insurers gain access to relevant, measurable data that can be used to better price and underwrite mortality risk. This can potentially shift the underwriting paradigm toward a continuous underwriting model where policyholders can benefit from their own improved health with lower premiums

Wearable devices also offer a way for insurers to stay connected with policyholders, creating opportunities for engagement that can improve customer loyalty. Some early movers have already seen a positive impact on public perception of their company.

Alignment of incentives

Some insurers are exploring partnerships to help policyholders manage critical medical conditions like cancer and heart-related illness. A recent Wall Street Journal article pointed out the alignment of incentives in such programs.

- “Consider an industry that excels in long-term planning and has a strong incentive to keep clients alive: life insurance.

- “Let’s say our 57-year-old has a $250,000 life-insurance policy. At the time of diagnosis, the incentives of the patient and those of his life insurer align more strongly [than those of his health insurer]. Both want him to live as long as possible. Every month of added life is a bonus for the insurer, both in postponing benefits and in collecting additional premiums

- “Studies are beginning to show that life insurers could save lives and help their bottom lines by purchasing cancer treatment for their clients."

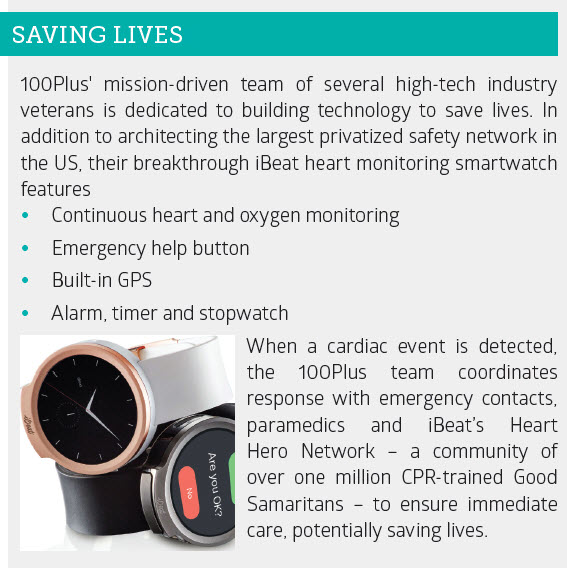

Cardiac arrest is the single largest killer in the world. For every minute that passes without intervention, a cardiac arrest victim’s survival chance drops by 10%. The iBeat heart watch is one example of life insurers and reinsurers partnering with health and wellness innovators like 100Plus to offer policyholder benefits that promote healthy lifestyle choices and help manage medical conditions.

Genetic testing

Health assessment and disease detection - Genetic testing is another area where life insurers and outside partners are forming alliances with the goal of helping people live longer.

For several decades, genetic testing and life insurance have been at odds. Life insurers worry about adverse selection and consumers worry about discrimination.

While hurdles remain, life insurers are beginning to see benefits. They are exploring the use of genetic testing products and services to help manage the health of older customers with high face amount policies. For example, (re)insurers are partnering and/or investing in genetic testing services to help policyholders catch and treat cancers, cardiovascular conditions, diabetes, etc. Health assessment companies like Human Longevity are keen to team up with life insurers as a way to access target markets for their genomic-based programs and services.

Managing inforce business

These programs may bring a new dimension to in force management strategies, which typically revolve around financial levers. Approaches such as retention management (e.g., Post Level Term strategies), in force block transfers, capital optimization, expense control and asset/liability strategies do not consider the lives behind the policies. Health and wellness programs, on the other hand, place customers at the strategic center.

Even though incentives are well aligned, the industry as a whole will need to make a shift to overcome a propensity to focus on technical aspects of the policy rather than actual customer needs. In addition, the existing industry structure presents additional hurdles; the regulatory environment, data security/privacy, legacy system challenges and reliable.

Ecosystems

Historically, life insurers have limited their products and services to risk coverages. Customer relationships have been passive with little or no interaction between policy issue and claims adjudication. Many industry experts no longer see this as a viable business model for the future. For one thing, it leaves little room to reinvent the business if market forces threaten established ways of doing business.

Life insurers are taking a hard look at their traditional roles. Some are purposefully forming strategic partnerships while a few pioneers are laying groundwork for a comprehensive, digitally driven “ecosystem” play.

The ecosystem concept, premised on a robust network of symbiotic partnerships and alliances, would position life insurers to expand into adjacent markets with hybrid solutions. Present endeavours focus on distribution partners, data providers and health-related services, but longer term, an ecosystem strategy would allow insurers to serve as a marketplace for a range of consumer products and services.

The best example of an ecosystem play comes from China: Ping An. Through a single customer portal, this giant insurer has expanded its offerings to include healthcare consultations, auto sales, real estate listings and banking services.

A recent article on the Wharton University website compares the Chinese approach to consumer markets to the Western approach. Two notable takeaways:

- “…while Western companies tend to focus on a single market…Chinese firms prefer a broad, horizontal play.”

- “…the main lessons the West can learn from the Chinese is in building integrated solutions and ecosystems that can get embedded into the lives of their consumers rather than focusing on only one particular product or service in isolation.”

No one expects such disruptive innovation to take place overnight, but the reality of today’s changing landscape demands that the insurance industry close the innovation gap. The health and wellness movement is one way life insurers are doing that.

Reinsurers as innovation brokers

Life insurers will need multiple partners and collaborators to initiate a roadmap and execute new strategies to remain relevant with the buying public. Reinsurers can be a valuable resource. Although risk management is a mainstay, top tier life reinsurers are taking on new roles as they invest in innovation and serve as advisors and intermediaries between clients and outside companies.

For SCOR, it’s imperative to be at the forefront of this movement, helping leverage the benefits of innovation and make its value available to direct writing companies.