- FR

- EN

Olivier Perraut, Chief Underwriting Officer, Specialty Insurance at SCOR Global P&C, and Lydia Sandner, Senior Associate, ESG Ratings and Regulatory Affairs, ISS ESG, explored at the 2019 SCOR Annual Conference the value of a company seen as closely tied to its relationship with its stakeholders and society and the ways in which this can be concretely assessed.

ESG: Helping companies help society

What is the purpose of companies? This is a question that is increasingly asked today. If law is justice as medicine is to health, then business is to what? Growth? Wealth? Wellbeing?

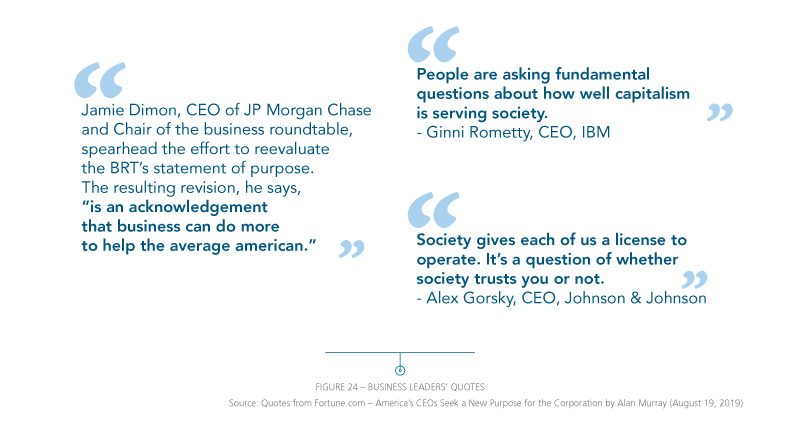

Public expectations in this respect are evolving. According to Fortune magazine, today 64% of Americans believe that a company’s primary purpose should be to “make the world better.” Experts like Paul Collier are questioning the future of capitalism…and he is not alone. Industry leaders themselves are assessing the relationship of business to society.

At the 2019 Business Roundtable, Chiefs Executive Officers of America’s leading companies issued a Statement on the Purpose of a Corporation. While recognizing the primacy of corporate purpose, they highlighted a company’s fundamental commitment to stakeholders, including customers, employees, suppliers and the communities in which businesses work. The reason is simple – they recognize that the future value of their companies depends on delivering value to their stakeholders.

How can insurers and reinsurers contribute? By making wise choices as to who they work with.

At the 2019 SCOR Annual Conference, Lydia Sandner of ISS ESG led a rich and stimulating conversation around ESG (Environmental, Social and Corporate Governance) and the issues it brings into play. ISS ESG rates companies on their ESG performance, helping insurers to pick and choose their partners according to their own corporate values and commitments.

What are some of the factors ISS ESG considers when they evaluate a company?

Our goal is to provide an independent evaluation of the social, governance and environmental performance of corporates across all sectors. We are not paid by the companies we rate. The coverage of our universe of rated companies is based on relevant stock indices and currently consists of around 9000 issuers. As part of our rating process and on top of using publicly available information, we invite the rated entities to provide additional information to help us assess the impact of their activities.

We base our criteria on international standards such as the Universal Declaration of Human Rights, the ILO Declaration on Fundamental Principles and Rights at Work, the United Nations Global Compact, industry standards, ISO certification and others. In some cases, we also take national legal labor standards into consideration. Aside from corporate ratings, we also offer country ratings – for sovereign bonds – and provide the data to investors.

In the ESG assessment of the insurance sector, there are five key issue areas:

- the company’s internal operations, including employee relations

- climate change including the impact in the value chain

- the company’s relation with its customers, including activities related to low-income customers and regions, and to high-risk groups

- asset management, including socially responsible investment and controversial investments

- insurance underwriting, including green insurance products, green claims management, contribution to the achievement of the SDGs (Sustainable Development Goals) and controversial underwriting

The SDGs provide an important framework for our assessments of corporates. For the insurance industry, opportunities to make a positive contribution include:

- SDG 1 – No Poverty: Insurance products for high-risk groups and low-income customers and regions:

- microinsurance;

- index insurance related to drought and rainfall;

- catastrophe pools; alternative risk transfer (CAT bonds).

- microinsurance;

- SDG 3 – Good Health and Wellbeing: insurance for people with pre-existing conditions or disabilities, as well as for elderly customers; micro health insurance.

- SDG 7 – Affordable and Clean Energy and SDG 13 – Climate Action:

- green insurance products, (e.g. lower premiums for hybrid or electric cars, eco-efficient buildings, certified appliances and machinery, or companies with environmental management systems);

- green claims management (for example repair instead of replacement, use of environmentally friendly and/ or recycled materials, use of eco-labelled appliances or machinery, and rebuilding to green standards).

- green insurance products, (e.g. lower premiums for hybrid or electric cars, eco-efficient buildings, certified appliances and machinery, or companies with environmental management systems);

Aside from these opportunities, we look carefully at controversial practices and the recurrence of claims for these practices. This can include selling unnecessary or unsuitable products, overcharging, in-admissive contractual clauses, and lack of or insufficient pay-out when a claim is made.

Responsible treatment of customers is high on our list

For example:

- Is the marketing material regarding costs and conditions comprehensive, accurate, not misleading, and easily understandable?

- Does the company ensure responsible sales practices by not incentivizing quantity over quality (in terms of commission and targets) and by conducting training and monitoring?

- Is claims management easy and fair?

- Are there internal reviews and independent ombudspersons?

On the risk side, we look at the underwriting process and ask ourselves:

- Does the company conduct client risk and impact analysis?

- Does it exclude activities such as controversial weapons, tobacco, coal, fracking and arctic drilling?

- Do the contractual clauses comply with human and labor rights, as well as health and safety management standards?

- Are there requirements in terms of environmental management and climate change strategies (emission intensities, risk exposure, scenario analysis, reduction targets, action plans) and biodiversity strategies?

- Does the company support engagement and awareness-raising with clients?

- Does it undertake monitoring and request improvement plans?

An insurer has a choice as to who they will work with. Overall, the insurers are increasing scrutiny and implementing restrictive policies when it comes to coal, tobacco, and certain types of weapons production.

What motivates companies to perform well in our ratings?

- Reputation: Customer demands and expectations can drive decisions at the corporate level as to who is acceptable as a business partner. Companies prefer to avoid putting their reputation at risk through involvement with controversial business partners.

- Good business: ESG makes good business sense. Good ESG risk management and taking opportunities like those mentioned above reduce risk and enhance future prospects for prosperity. Better long-term investment choices mean better performance.

- Good corporate citizens: Enlightened companies are more aware of their responsibilities as citizens. As an employer, this contributes to attracting and retaining talent from a pool of well-qualified professionals

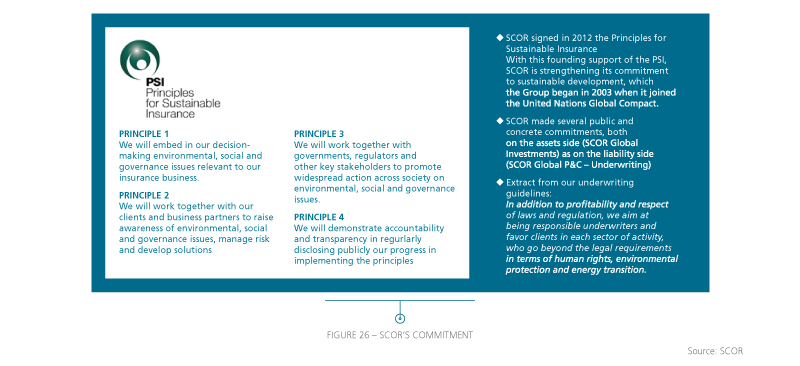

SCOR’s commitment

SCOR’s commitment to Corporate Social Responsibility (CSR) is strong. In 2012, we adhered to the Principles for Sustainable Insurance and we belong to the United Nations Global Compact. In deciding who we want to support, our underwriting guidelines are clear: we are sensitive to issues in the areas of health, environmental impact and human rights. At the same time, we work to increase our clients’ awareness of environmental risks, encouraging them to develop a sustainable approach.

We are tracking our evolution over time – after all, “what gets measured gets managed“ we are pleased to partner with companies like ISS ESG to challenge and help us improve our approach.

Authors

|

Olivier Perraut, Chief Underwriting Officer, Specialty Insurance at SCOR Global P&C, is an engineering graduate of the Ecole Centrale Paris. He started his career with Technip (Oil and Gas contractor) as a Process Engineer, then successively became a Startup Engineer and Project Engineer. After joining SCOR’s Energy department in Paris, he spent 7 years in Singapore as Deputy then Regional Manager for Business Solutions. Then, he became Chief Underwriting Officer in charge of the Oil & Gas, Power, Mining and Shipbuilding sectors, globally and across Property and Casualty lines, heading a team of underwriters located in Paris, London, New York, Toronto, Rio and Singapore. He has been Chief Underwriting Officer with SCOR P&C – Specialty Insurance since May 2018.

|

|

|

Lydia Sandner, Senior Associate, ESG Ratings and Regulatory Affairs, ISS ESG, has a background in International Relations (BA) as well as International Trade Law and Economics (MA), which she studied in the UK, Sweden and Switzerland. She joined ISS ESG, then Oekom research, in 2011 as an ESG analyst. For several years, Lydia has been the sector specialist responsible for the insurance sector, and the in-house expert on corporate sustainability reporting. She also heads the regulatory affairs team working on sustainable finance regulation.

|