Responsible Investment

In its 2016-2019 strategic plan “Vision in Action”, the SCOR Group reaffirms its commitment to applying Environmental, Social and Governance (ESG) criteria in the management of its financial assets. In its aim to invest responsibly, SCOR has adopted an approach that is more pragmatic than dogmatic.

Through targeted investments, SCOR applies a consistent approach that combines risk analysis, impact and exclusion. The Group’s ESG policy is based on carefully selected themes that are consistent with the Group’s DNA:

Risk-management – the Foundation of the Group’s business – notably in terms of adapting to the consequences of climate change. SCOR capitalizes on its expertise to analyze the exposure of its asset portfolio to climate change risks, whether potential physical risks to its real-estate and infrastructure investments, or so-called transition risks to investees’ activities.

Impact investments, through targeted holdings in:

- renewable energy sources, energy-efficient buildings, and other assets forming part of the transition to a low carbon economy,

- insurance-linked securities – like traditional reinsurance, these contribute to the financing of reconstruction after natural catastrophes, thereby helping people and societies to adapt to climate change,

- the life and knowledge science industries, which play an important role in the wellness and the empowerment of people through advanced medical treatment and enhanced knowledge transmission and dissemination.

Targeted exclusions applying to either economic sectors or companies, on the basis of quantitative and qualitative criteria.

The inclusion of ESG criteria is also achieved through qualitative assessment of the asset portfolio. Given the extreme diversification of its investments, SCOR has chosen the independent non-financial ratings agency oekom research to assess the quality of the standard instruments on its portfolio. For the least conventional asset classes, such as debt instruments, the Group relies on the expertise of its subsidiary SCOR Investment Partners, a recognized leader in the European debt instrument management industry.

The assets covered by ESG criteria through selected themes and/or qualitative assessment therefore include government bonds, agency bonds, corporate bonds, equities, real-estate debt, infrastructure debt and direct real estate investments. The portfolio also includes investments in risks related to natural catastrophes, i.e. insurance-linked securities, and limited investments in private equity.

was managed

in accordance

with ESG criteria

C

Average

C

AverageESG rating

1.2

Eur billion

1.2

Eur billionGreen part of

SCOR’s invested

assets portfolio

125

EUR MILLION

125

EUR MILLIONInsurance-linked

securities

54%

of infrastructure debt

54%

of infrastructure debtfinances the energy

transition or social

development

160

Euros Million

160

Euros MillionInvestments in life &

knowledge sciences

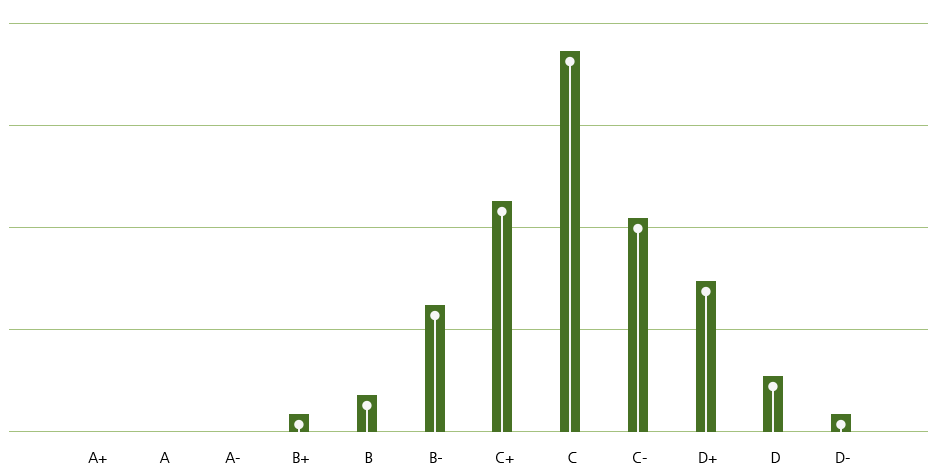

ESG rating distribution by investment amount, Q4 2017